Table of Contents

Loading table of contents...

The Cost of Escalation Delays in Lending Ops

- Uncover the true cost of escalation delays in lending Ops. Explore how miscommunication and disjointed systems lead to lost time and increased risk. How issues spend hours in the wrong Slack/Email thread before they reach the right owner.

September 6, 2025

AB

If you’ve worked in lending ops, you know this one:

“Disbursement stuck - customer hasn’t received funds since yesterday evening. Can someone check?”

No context. No ticket ID. Just a screenshot from the borrower’s email.

An ops analyst tags finance. Finance says it looks like a bank issue. After an hour, they loop in the tech team. Tech says they need logs from the LOS. By lunchtime, the borrower has already escalated to the relationship manager. By the time the right disbursement-ops person gets eyes on it, the case is 6 hours old.

That’s half a working day - lost in transit.

Multiply this by dozens of similar threads every week. The “small stuff” adds up. This is the hidden Cost of Escalation Delays in Lending Ops that most leaders underestimate.

Why These Escalation Delays in Lending Ops Happen

Escalations don’t get delayed because people are careless. They get delayed because the system is set up in a way where delays are inevitable.

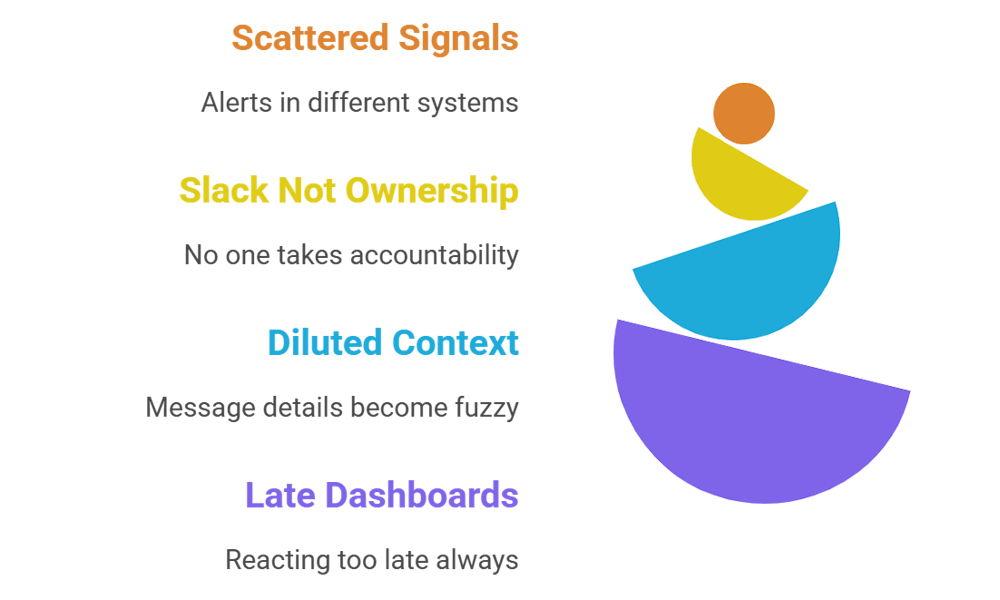

- Signals are scattered. LOS throws an alert in one place, payments in another, collection CRM somewhere else. None of it lands in one “nerve center.”

- Slack ≠ ownership. A tag or a forwarded email isn’t accountability. Until someone says, “This is mine,” the issue is floating.

- Context gets diluted. Every time a message hops from Slack → email → Excel → back to Slack, the original details are fuzzier.

- Dashboards show up late. By the time a daily MIS pack surfaces yesterday’s failures, you’re already reacting too late.

So ops teams spend their days in relay mode, passing escalations around like a hot potato, instead of fixing them at source. And this cycle is exactly what defines the Ops Escalation Delays in Lending we keep running into.

Checkout: Alert Fatigue in Lending Ops: Fixing the Wrong Things First

The Real Cost of These Delays

On paper, a few hours here or there don’t sound catastrophic. But in lending, time magnifies risk.

- Delayed disbursements erode trust.

If a borrower doesn’t see funds land on time, it’s not just an inconvenience. It signals unreliability. For institutional partners, one missed SLA can sour an entire relationship. - Silent failures become delinquency.

That missed repayment posting that nobody caught on Monday? By Friday it’s a delinquent case. Every extra day increases the likelihood that the borrower slips into a harder-to-recover bucket. - Regulatory exposure creeps in.

Reporting deadlines don’t care if your Slack thread was messy. Late reconciliations or incomplete audit trails translate to fines and questions from the regulator. - Ops burnout goes up.

When your smartest people spend hours just chasing who owns what, morale drops. Attrition rises. Then you’re not only losing time, you’re losing talent.

Here’s the kicker: what feels like “ops friction” is actually a direct P&L impact. Lost trust, delayed revenue, higher cost of collections, compliance risk - all of it is measurable. And the Cost of Ops Escalation Delays in Lending only grows as your book scales.

Checkout: Top 6 Ways to Improve Business Operations (That Actually Work)

What “Good” Looks Like in Escalation Management

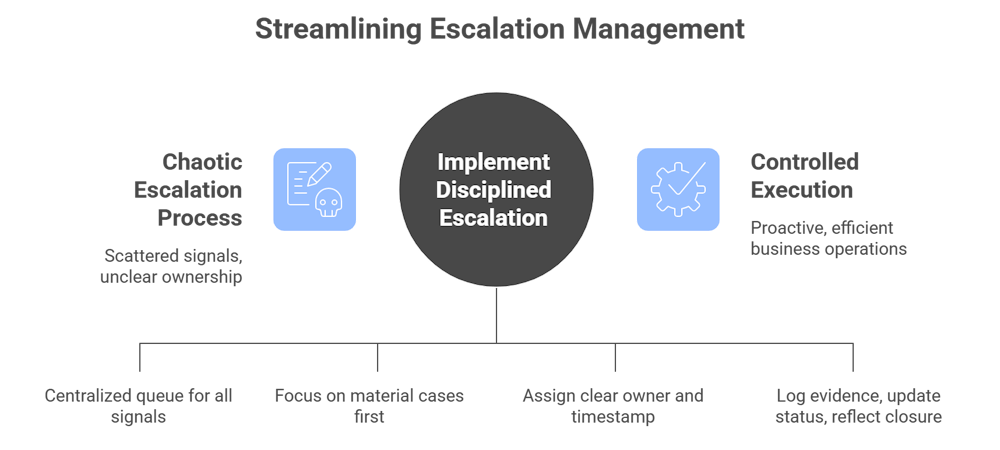

If we strip away the noise, the fix isn’t complicated conceptually, but it does require discipline:

- Single Source of Escalation Truth

All signals land in one queue. No scattered inboxes. No hunting across 5 tabs. - Prioritization by Risk & Value

A ₹50 lakh disbursement failure does not get buried under a ₹500 retry. Priority views ensure the right eyes are on the most material cases. - Ownership by Default

Every escalation has a name and timestamp attached. Not a Slack @channel, but a clear owner. - Closure Loops

The issue isn’t resolved until evidence is logged, status is updated, and MIS reflects the closure.

When this happens, the whole tone of business ops in lending changes. From firefighting to controlled execution. From reactive to proactive.

Where Autonmis Fits In

We built Autonmis with this exact pain point in mind.

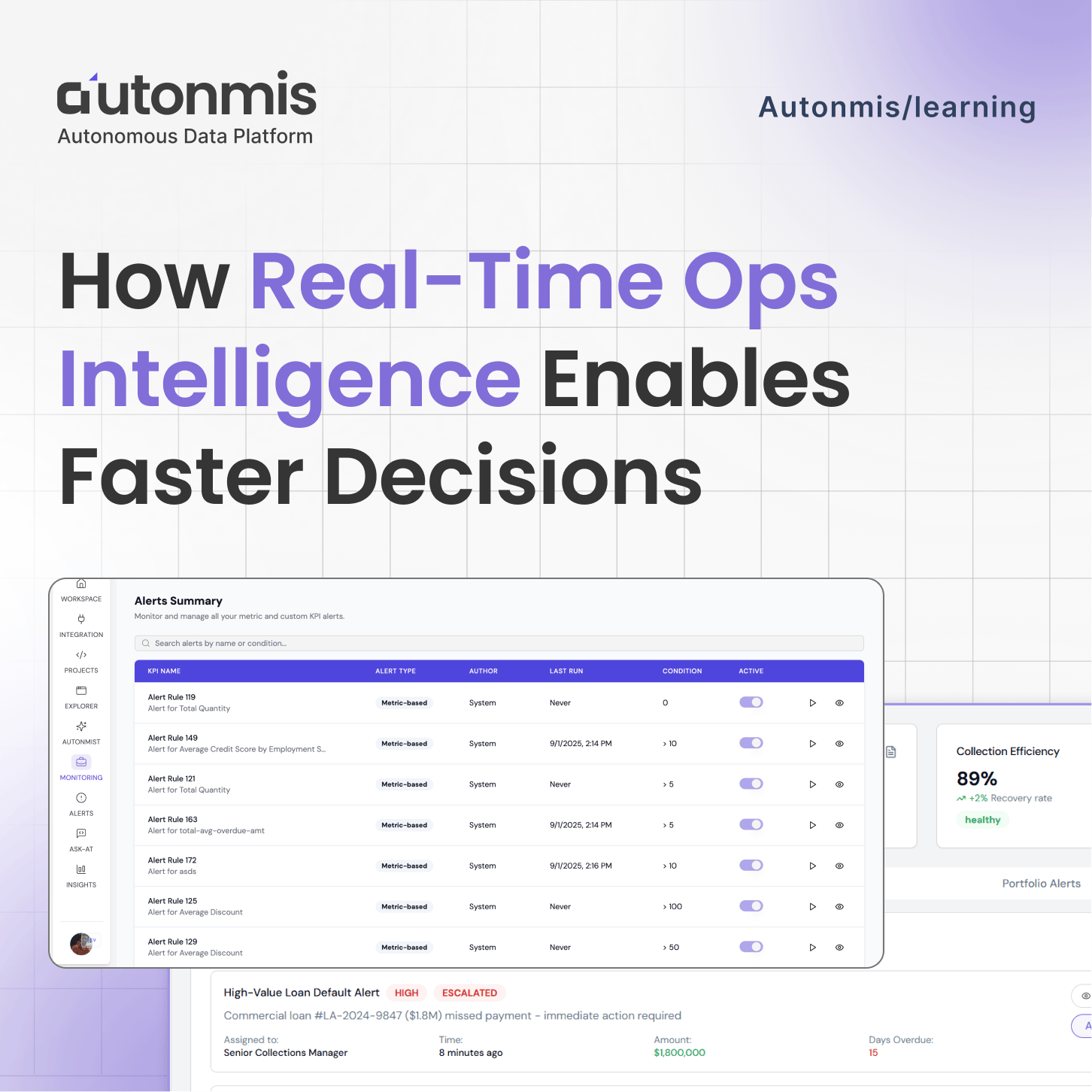

Instead of treating escalations as “messages to be routed,” we treat them as work to be owned.

- Stuck disbursements, failed mandates, delinquent cohorts - they surface instantly in one place.

- Escalations are assigned automatically with SLA clocks ticking.

- High-value or time-sensitive cases float to the top, so leaders know nothing material is slipping.

- Every action leaves an audit-ready trail - no more backtracking through Slack history during compliance reviews.

For ops leaders, this translates into measurable outcomes: faster resolutions, fewer silent failures, less manual MIS prep, and a portfolio that feels under control instead of under siege.

Checkout: How to Improve Operational Efficiency in Fintech

The Bigger Reflection

Escalations will never disappear. Lending is too complex, with too many moving parts, for that.

But delays? Those are optional. They exist because ops infrastructure hasn’t caught up with the reality of scale.

The question every lending leader has to ask is simple:

- Do you want your most critical issues bouncing around inboxes for half a day?

- Or do you want them landing with the right owner in minutes, with full context and accountability baked in?

Because in lending, every hour of delay is not just a workflow cost. It’s trust, money, and reputation leaking out the back door.

And those are the costs you can’t afford to keep writing off.

Recommended Blogs

2/10/2026

AB

How Real-Time Ops Intelligence Enables Faster Decisions

12/24/2025

AB

How Operations Teams Stop Repeating the Same Fixes

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.