8/5/2025

AB

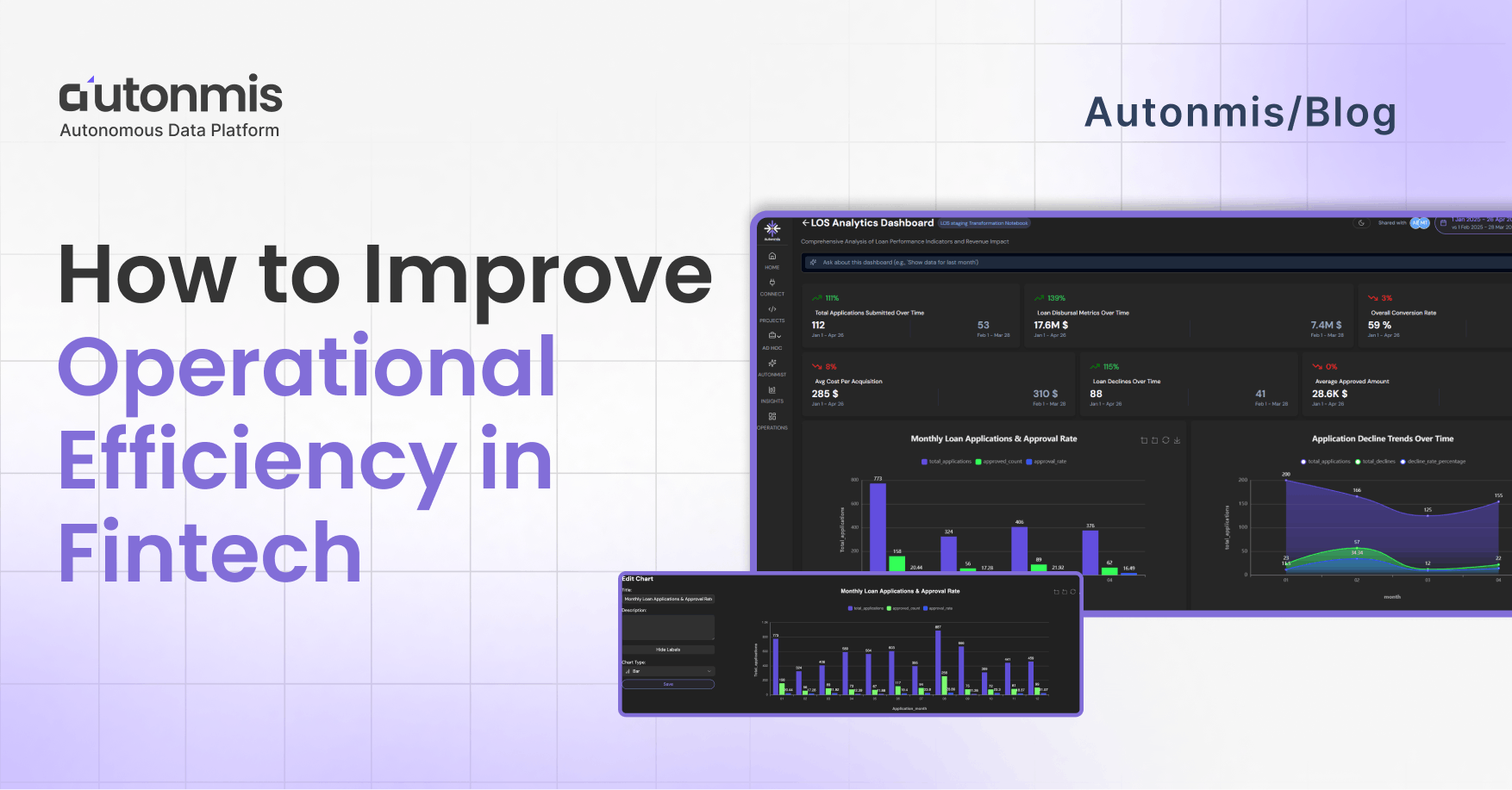

How to Improve Operational Efficiency in Fintech

Discover how to improve operational efficiency in fintech by overcoming common blockers. Learn actionable strategies for sustainable growth and compliance.

“In fintech, speed without control is chaos. Efficiency without insight is blind.”

— Anonymous Ops Lead

Operational efficiency in financial services isn’t just about cutting costs, it’s about enabling teams to move faster, innovate smarter, and delight customers without sacrificing compliance or control. In this article, we’ll unpack the real blockers holding fintech companies back, surface battle-tested practices (and emerging tactics!), and show you how to improve operational efficiency in a way that’s sustainable, scalable, and strategy-aligned.

Why “Efficiency” Feels Elusive in Fintech

Most organizations fire off one or two “improve ops” projects a year—install an RPA bot here, spin up a dashboard there and they hit diminishing returns fast. Why?

- Siloed Data & Legacy Spaghetti

- Tool Overload

- Compliance as a Roadblock

- Human Bottlenecks

Reality check: Oracle data shows firms can improve operational efficiency in Fintech by up to 70% when they unify data and automate repeatable processes. But few do this holistically.

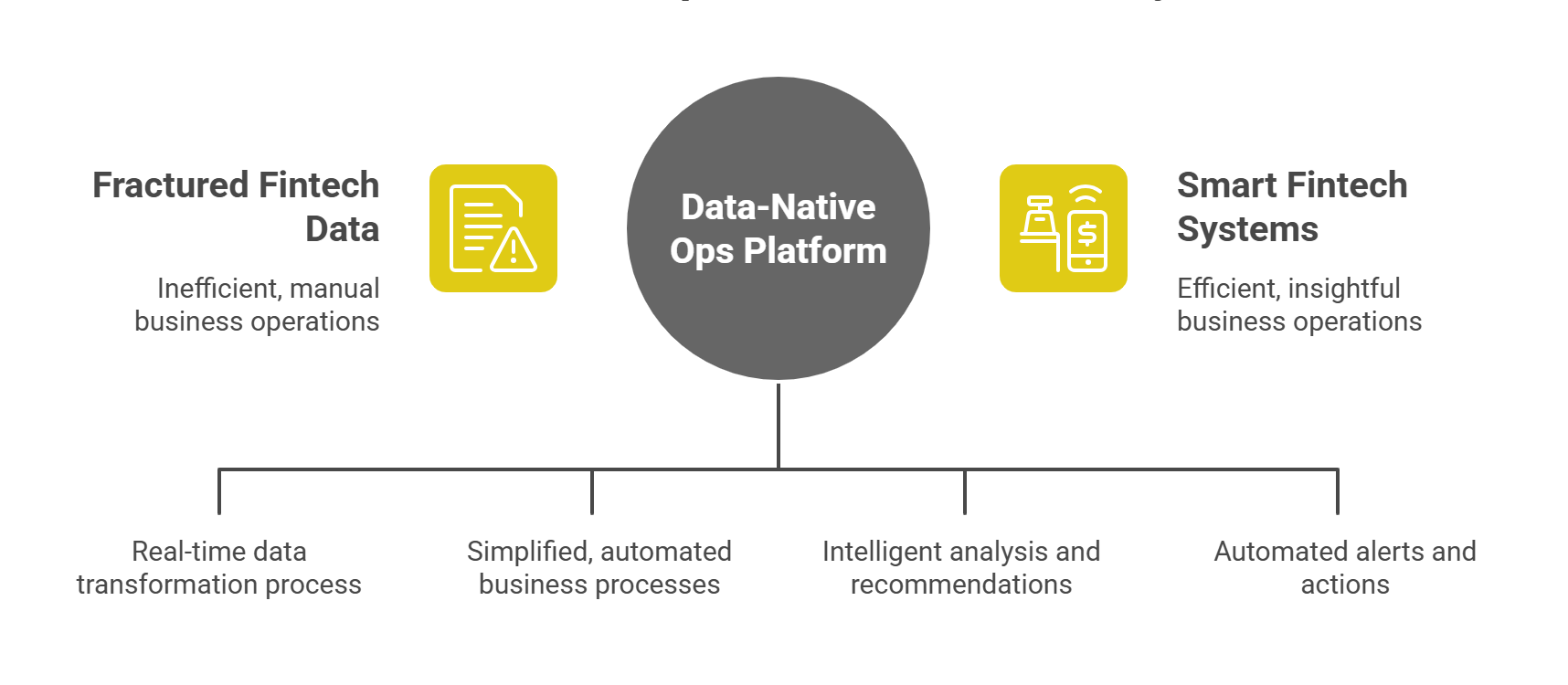

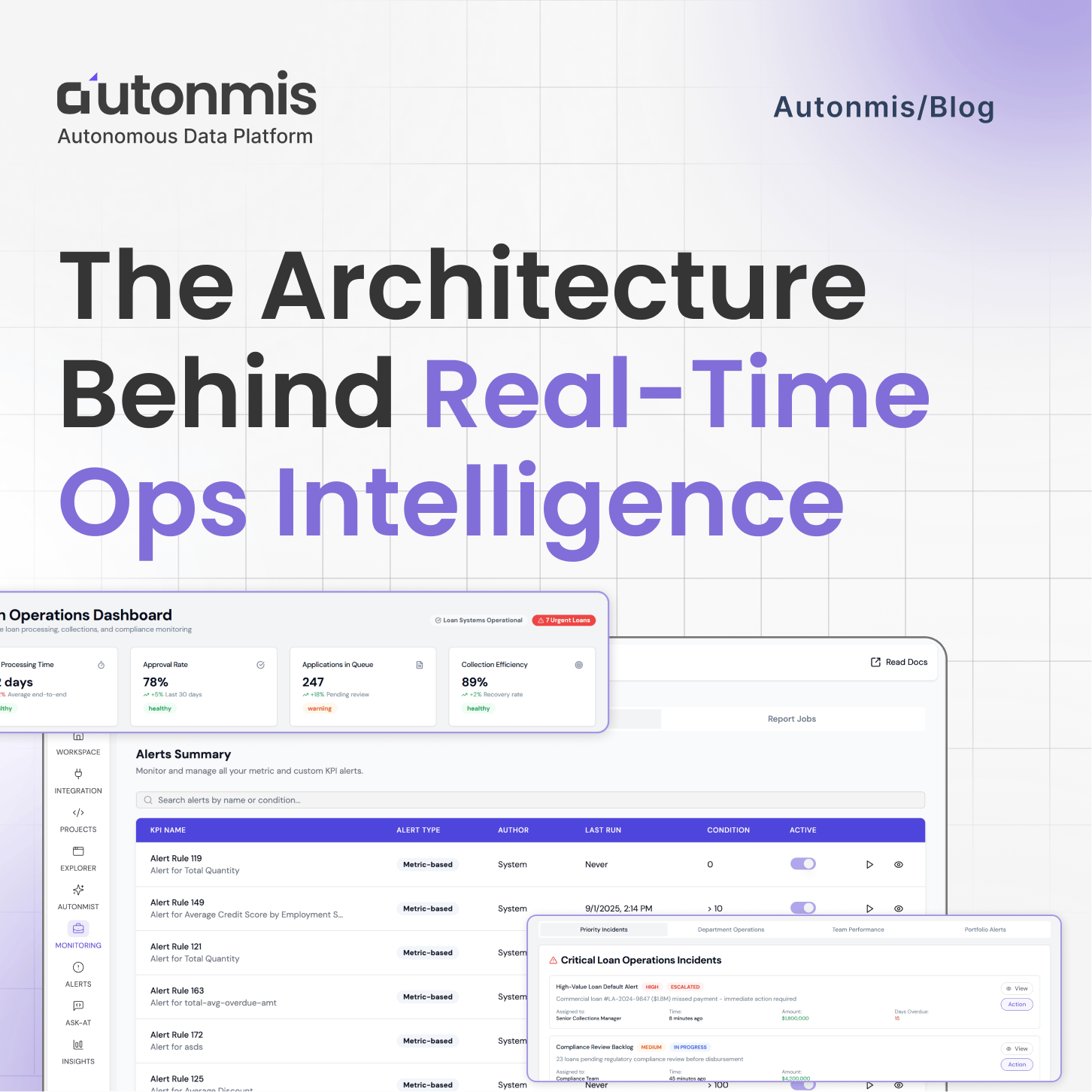

The Next Wave of Efficiency: From Dashboards to Data-Native Ops

Rather than slapping a fresh BI layer on top of fractured data, top-performing fintechs are learning how to improve operational efficiency by embracing a data-native ops platform.

- Live data ingestion and transformation

- No-code and low-code workflows

- AI-enhanced copilots for analysis

- Embedded automation and alerting

This isn't just modernization. It's a mindset shift toward smart systems that improve business operations in Fintech with less manual effort and more actionable insight.

Checkout: How to Improve Business Operations: A Practical Guide

Core Pillars to Implement Today

Below are seven tactical pillars - each battle-tested in leading Fintech that you can adopt in the next 90 days.

1. Centralize and Democratize Data Ingestion

- No-code ETL pipelines: Empower ops teams to connect to Salesforce, Stripe, S3, or your data warehouse through a visual builder - no tickets, no SQL.

- Event-driven syncs: Move from nightly batch jobs to on-demand triggers (e.g., “when a loan’s status changes to ‘approved,’ sync to downstream systems”).

Tools in market: Spyro-Soft’s RPA-driven pipelines deliver quick wins, but lack built-in governance and audit logs. Look for platforms embedding lineage tracking and RBAC by default.

2. Build Hybrid SQL+Python Notebooks as Living Analysis Canvases

- Multi-step workflows: Combine raw data transformations (SQL) with advanced logic (Python) in a single canvas.

- Drag-and-drop charting: Instantly convert query outputs into visuals, then stitch them into dashboards or reports.

This beats siloed BI tools where analysis is divorced from execution. Your ops leads can prototype new KPIs in minutes, ship them to production, and retire outdated ones - all in one place.

3. Layer in AI-Powered Assistance

- Autocomplete & schema-aware suggestions reduce syntax errors and training friction.

- Natural-language prompts let non-technical users ask, “Show me last month’s approval time by region,” then generate the notebook for them.

Generative AI isn’t just a gimmick, it can save 30–50% of analysts’ time on routine tasks and ensure consistency across models.

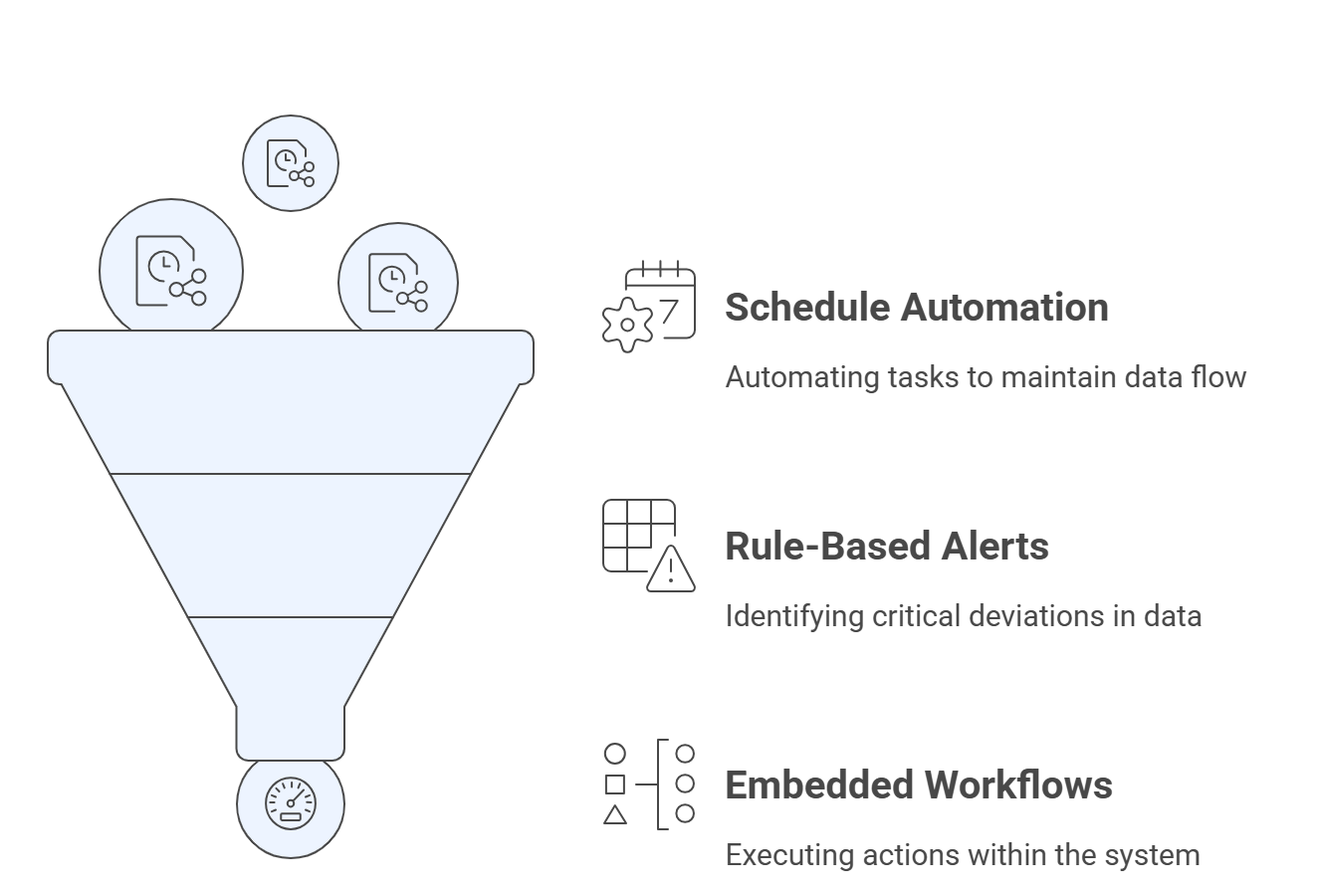

4. Automate Scheduling, Alerts & Embedded Action

- CRON or event scheduling keeps pipelines, notebooks, and reports in sync.

- Rule-based alerts fire only on critical deviations (e.g., delivery delays > 3%, revenue dips > 5%).

- Embedded workflows (approve, escalate, drill through) close the loop without jumping tools.

This approach slashes mean-time-to-resolution. Instead of manually refreshing dashboards, your team reacts to real exceptions.

Checkout: Financial Risk Analysis

5. Enforce Governance & Auditability by Design

- Versioned notebooks and pipelines: Every change is tracked, reviewable, and revertible.

- Role-based access controls ensure only authorized users can modify production logic.

- Automated lineage and metadata catalogs map data flows end-to-end for compliance and impact analysis.

High-growth fintechs can’t trade speed for security. Bake governance into your ops platform so auditing is frictionless - no late-night fire drills.

6. Surface Contextual, Action-Ready Dashboards

- Live dashboards as data portals: Curated collections of KPIs, charts, and interactive selectors.

- In-app drill-downs let you explore anomalies without exporting to another tool.

- Embedded collaboration (comments, tagging) keeps the conversation next to the data.

Think beyond static scorecards: deliver control towers for specific teams (e.g., loan ops, marketing, supply chain) that answer “What do I need to do right now?”

7. Iterate with Metrics & Continuous Feedback

- Measure your measures: Track adoption (notebook runs, alert acknowledgements), ROI (time saved, error reduction), and NPS among ops stakeholders.

- Agile cadences: Review metrics monthly, retire low-value reports, and prioritize new features based on direct feedback from end users.

True efficiency is a moving target. Regularly calibrate your program to evolving business needs, regulatory changes, and technological advances.

A Real-World Snapshot

Case Study: FinEdge Lending

Faced with a surge in loan processing delays, they applied these principles to improve operational efficiency in Fintech, cutting turnaround time by 75% and boosting customer retention.

Beyond the Horizon: What’s Next for Fintech Ops

- Streaming & real-time analytics for true instant reaction.

- Embedded decision-automation (e.g., auto-approve low-risk loans).

- Cross-org data exchange - share sanitized operational metrics with partners or regulators without hand-built pipelines.

If you’re still wrestling with manual SQL requests, fragmented tools, and stale dashboards, now is the moment to evolve. Embrace a data-native ops control tower - one that equips your teams with:

- Frictionless self-service

- Built-in governance

- Actionable AI guidance

…and watch efficiency become your competitive moat.

Checkout: Analyze Loan Performance with Autonmis: Insights from Multi-Source Data

Final Word

If you're wondering how to improve operational efficiency without drowning in dashboards or duct-taped tools, it's time to rethink your stack.

With a data-native approach that’s open, flexible, and secure, you’ll not only improve operational efficiency in Fintech, you’ll give your team time and clarity back.

Want to See This in Action?

At Autonmis, we’re building the control tower for modern fintech operations. Reach out to see how we help companies like yours improve business operations in Fintech with speed, clarity, and trust built in.

Recommended Learning Articles

2/6/2026

AB

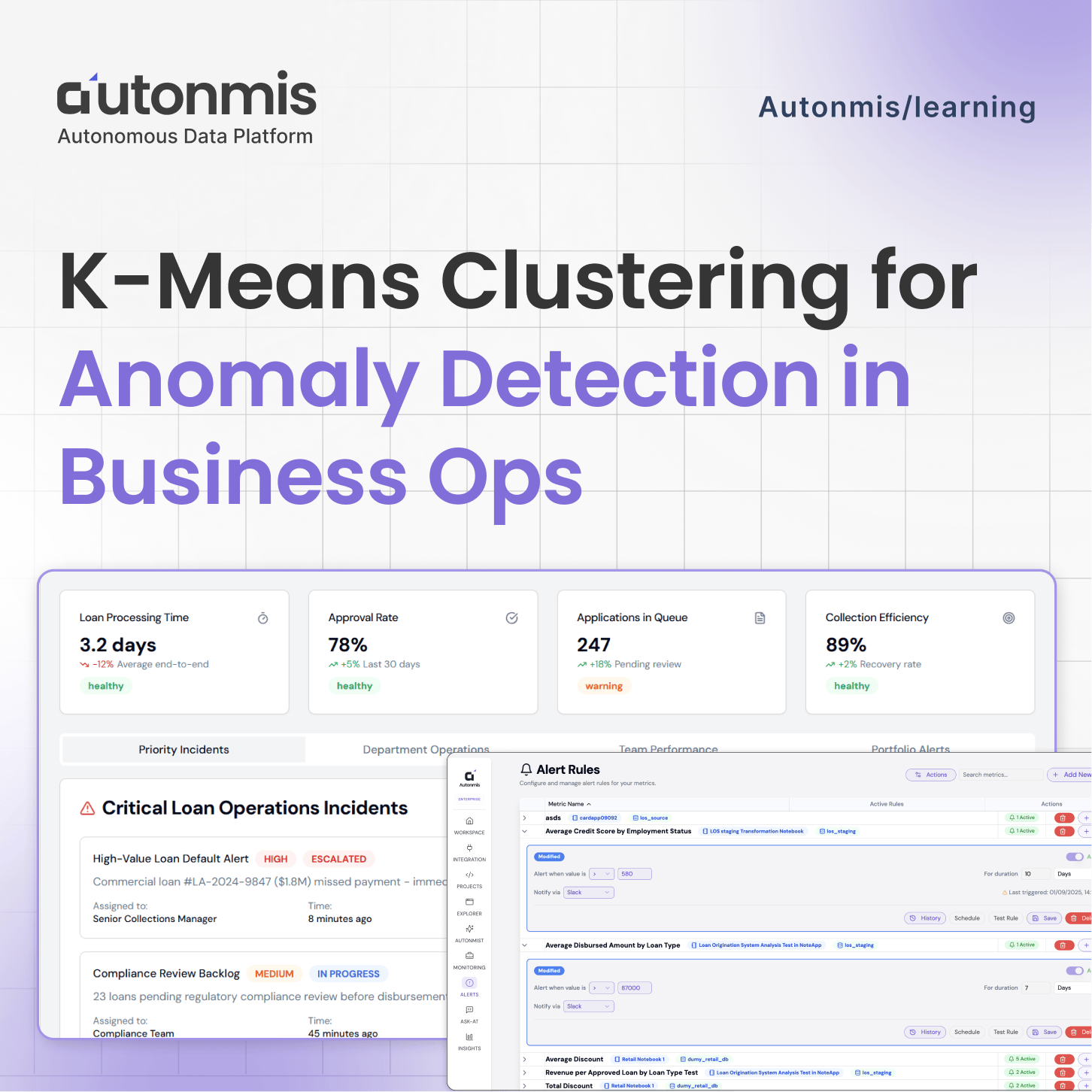

K-Means Clustering for Anomaly Detection in Business Operations

1/15/2026

AB

The Architecture Behind Real-Time Ops Intelligence: RAG + NL2SQL Explained

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.