Table of Contents

Loading table of contents...

How GFF 2025 Changes the Way BFSI Will Operate in India

GFF 2025 unveils India's financial future with next-gen UPI features. Experience enhanced automation, connectivity, and user control in digital finance like never before.

October 17, 2025

AB

India's financial ecosystem's future is revealed annually at the Global Fintech Fest (GFF).

This year, however, felt different.

GFF 2025 signaled a transition from capability to production-grade intelligence across digital operations, banking, and payments. It wasn't just about introducing new features.

One thing is evident from the announcements made in Mumbai: India's financial system is about to enter a phase of increased connectivity, automation, and accountability.

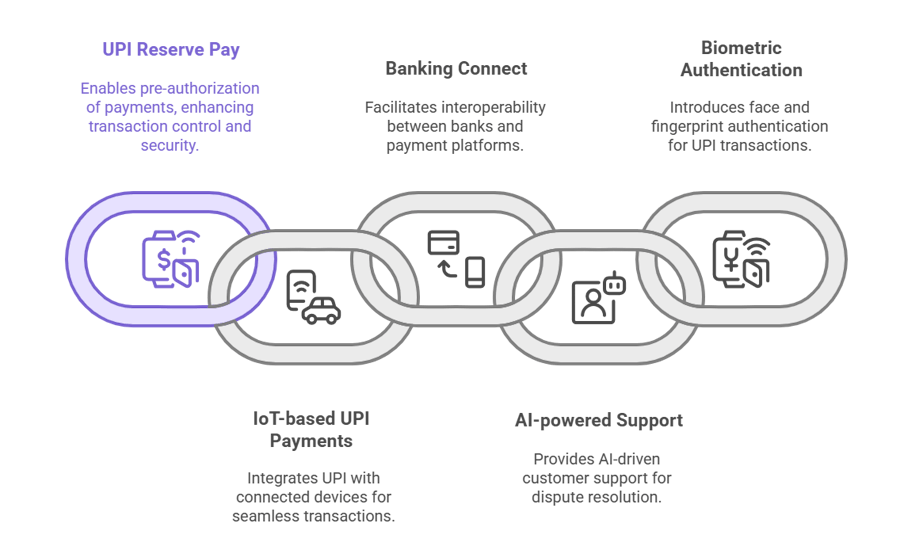

What Was Announced: The New Building Blocks of Digital Finance

The National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI) unveiled a number of next-generation UPI features and ecosystem enhancements at GFF 2025, all aimed at enhancing user experience, dependability, and interoperability.

1. UPI Reserve Pay

enables pre-authorization of payments for both users and merchants; this system is comparable to credit reservation.

It gives users more control over transactions and assists merchants in making sure funds are blocked prior to settlement.

This entails new transaction states for operations teams, such as "reserved but not settled," as well as more data points for risk monitoring and reconciliation.

2. IoT-based UPI Payments

Now, UPI will work with connected devices, allowing payments to be made straight from wearables, cars, or appliances.

For instance, a car could use UPI to refuel or pay a toll automatically.

Although this is smooth for users, it introduces new operational requirements for event sequencing, transaction metadata, and device authentication.

3. Banking Connect (IBMB)

By introducing Interoperable Banking Connect, Easebuzz and NPCI Bharat BillPay made it possible for banks, aggregators, and payment platforms to integrate more easily.

Although this interoperability creates new integration checkpoints to keep an eye on, it may also lessen reconciliation mismatches that arise when multiple systems handle a single transaction.

4. UPI HELP (AI-powered support layer)

An AI-powered customer support layer that helps users with disputes, fixes payment problems, and expedites the complaint process.

Although specifics are still being worked out, this could be the first step toward automating post-payment processes.

5. Biometric Authentication for UPI

In order to eliminate the need for PINs and OTPs, NPCI also announced face and fingerprint-based authentication for UPI transactions.

In pilot mode, the biometric setup for UPI PINs is already operational.

However, this shift adds operational complexity: if biometric verification fails, fallback methods like OTP must trigger instantly to avoid user friction or transaction drop-offs.

Checkout: Alert Fatigue in Lending Ops: Fixing the Wrong Things First

What It Means for Operations Leaders

These kinds of announcements may sound futuristic, but they have immediate repercussions for BFSI and fintech operations teams.

With each new development, the metadata surface area grows by adding more edge cases, data fields, and transaction states.

What leaders should remember is this:

1. New Metadata, New Failure Modes

New transaction states are introduced with each new capability.

Exceptions increase if your dispute or reconciliation systems aren't updated to incorporate these; this isn't because the system is flawed, but rather because it is ignorant.

To prevent blind spots, operations should proactively map and normalize new metadata (such as reserve flags, biometric status, or IoT trigger IDs).

2. Automation Needs Context, Not Just Speed

However, even proper automation may cause regulatory issues in the absence of audit trails and decision logs.

Every “auto action” must leave a traceable explanation - why the system acted, not just what it did.

3. Fallback Paths Define Experience

Biometric and IoT-triggered payments make user experience binary: either flawless or visibly broken.

A smooth fallback (e.g., switch to OTP, manual review) is now as important as the success flow itself.

Instead of focusing only on creating ideal journeys, leaders should invest in creating paths of graceful degradation.

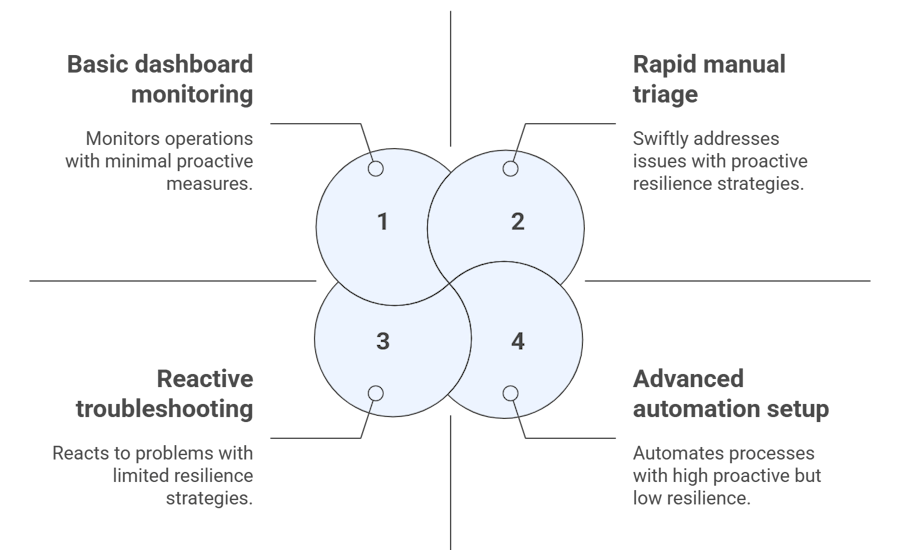

4. Operational Resilience Is the Real Differentiator

There are frequently brief periods of confusion during the early rollout phase of new payment rails, including connector bugs, mismatched states, and untagged exceptions.

These shocks will be absorbed more quickly by teams that prepare by testing ingestion pipelines, creating dashboards for "unknown" states, and enabling rapid manual triage.

In this situation, resilience is about being aware sooner rather than better.

Checkout: The Cost of Escalation Delays in Lending Ops

Beyond the Announcements: The Silent Challenge

The real test for BFSI operations isn’t whether these innovations arrive, it’s how well organizations absorb them.

When a new UPI feature launches, most firms focus on integration deadlines.

Few focus on what comes next:

- How is “reserve” stored in your database?

- What happens when biometric auth fails mid-transaction?

- Is your reconciliation engine ready for IoT-triggered event IDs?

These small alignment gaps are what quietly slow entire systems.

A single untracked metadata field can turn a solvable case into a multi-day backlog.

This invisible layer - the part between what’s announced and what’s actually understood by your systems - is where operational excellence (or chaos) begins.

Looking Ahead

The fintech infrastructure in India is developing more quickly than most operational frameworks anticipated.

Adopting every innovation at once won't lead to the next phase of advantage; instead, it will require intelligent change absorption, including mapping every new signal, validating every backup, and treating metadata like a first-class citizen in operations.

Because the future of payments involves more than just transferring funds more quickly; it also entails comprehending each micro-state that occurs between initiation and settlement and making that process transparent, traceable, and robust.

At Autonmis, we believe that true operational advantage comes from seeing what others don’t - capturing every new payment state, monitoring fallbacks, and learning from each transaction. GFF 2025 shows that innovation alone isn’t enough; how teams absorb, instrument, and act on these changes will define who scales smoothly and who scrambles.

Our focus is helping operations leaders build that visibility and resilience so that every rollout becomes an opportunity, not a risk.

Recommended Blogs

2/10/2026

AB

How Real-Time Ops Intelligence Enables Faster Decisions

12/24/2025

AB

How Operations Teams Stop Repeating the Same Fixes

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.