Table of Contents

Loading table of contents...

Top 5 Ways to Improve Lending Operations for Business Growth

Discover 5 actionable ways to improve lending operations. Boost approval rates, reduce losses, and streamline processes for measurable business success.

October 13, 2025

AB

Faster processing is only one aspect of lending operations; another is obtaining dependable, quantifiable business outcomes. Higher approval rates, reduced losses, fewer manual errors, and speedier product launches are all examples of this. Here are 5 concrete ways to improve lending operations. Each one has concise tactics you can share with your teams and is written in an easy-to-read manner.

1. Transform alerts into actionable incidents

Problem: Although dashboards and alerts highlight problems, they hardly ever provide guidance on what to do next.

Fast fix:

Every alert should be handled as an incident, complete with the following information: the impact estimate (which KPI is impacted), the suggested owner, the evidence (what changed), and the next steps.

Keep it brief: just include a one-line plan and the three most crucial facts.

In a week, complete this:

- Select two recurring alerts (such as a decline in the approval rate or a failure in the reconciliation).

- For each, specify which evidence should be attached and which individual or group is in charge of the initial action.

Why it matters: it speeds up remediation, decreases back and forth, and accelerates the improvement of metrics - improving lending operations for business growth.

Measures: include the percentage of incidents that are auto-assigned and the mean time to remediate (MTTR).

2. Set priorities based on KPI impact rather than noise.

Issue: Teams chase unproductive technical alerts that don't advance the company's goals.

Fast fix:

- Include the KPI that each alert affects (approval velocity, delinquency, and disbursal rate) along with an estimate of the business impact.

- KPI-sensitive triage: warnings that could jeopardize revenue or customer satisfaction are given precedence.

In two weeks, complete this:

Assign common alerts to your top five KPIs. Add an impact score (high, medium, or low) and the impacted KPI to alerts.

Why it matters: attention is kept on what increases or safeguards revenue. This is one of the most useful ways to improve business operations.

Measure: % of high-impact alerts handled within SLA.

Checkout: The Future of Business Operations: From Firefighting to AI-Driven Flow

3. Make signals understandable by providing a brief "why."

The issue is that alerts are opaque. Ops wastes time trying to identify the causes.

Fast fix:

- Give each incident a one-paragraph "why" that includes the top two drivers and a small sample of the impacted accounts.

- For explanations, use straightforward, interpretable models (decision trees or scorecards); sophisticated machine learning is not necessary.

In a month, complete this:

Display a 10-row sample and the top three contributing fields for a single alert type. et ops mark whether the explanation helped.

Why it matters: faster decisions, fewer escalations to data teams.

Measure: % incidents closed at first touch.

4. Automate low-risk triage while retaining human judgment

Problem: Humans are performing low-value, repetitive tasks that can be automated.

Fast fix:

- Sort the triage steps into three categories: expert-only, human-in-loop, and automated.

- Automate tasks that are obviously rule-based first, such as small-dollar auto-approvals with verified identities and score-based account routing to collections.

In 30 to 60 days, complete this:

Select a triage flow, run it in "shadow mode" (the system makes suggestions but doesn't take action), compare the results, and then switch it to live.

Why it matters: it frees up staff time for challenging issues and cuts down on processing time.

Metric: weekly percentage of time saved and automated triage tasks.

5. Build small, focused data apps for ops - not more dashboards

Issue: BI has too many tickets, and operations requests ad hoc reports.

Fast fix:

- Convert the top three frequently asked questions into mini data apps with filters and an obvious action button: "pause a product," "re-run scoring," and "route to collections."

- One question, one action should be the focus of each app.

In two to four weeks, complete this:

List the top three ad hoc requests. Create an app for each and teach the operations team how to use it.

Why it matters: shortens decision cycles and decreases BI backlog.

Ad hoc BI request volume per month is the measure.

Checkout: The Hidden Cost of Manual Operations in BFSI

Final Thoughts

Make adjustments gradually. Start with a single flow and KPI, demonstrate successes, and then grow. Prioritize consistency and quantifiability in your work because small, noticeable victories foster trust and support considerably more quickly than large, flawless undertakings.

A short note: Autonmis helps make these improvements easier to implement by connecting operational workflows, KPIs, and data insights in one place. Teams can turn alerts into actionable tasks, track progress, and automate repetitive triage, all while keeping humans focused on the decisions that matter most. It’s designed to help lending teams move faster, smarter, and with more confidence.

Recommended Blogs

2/10/2026

AB

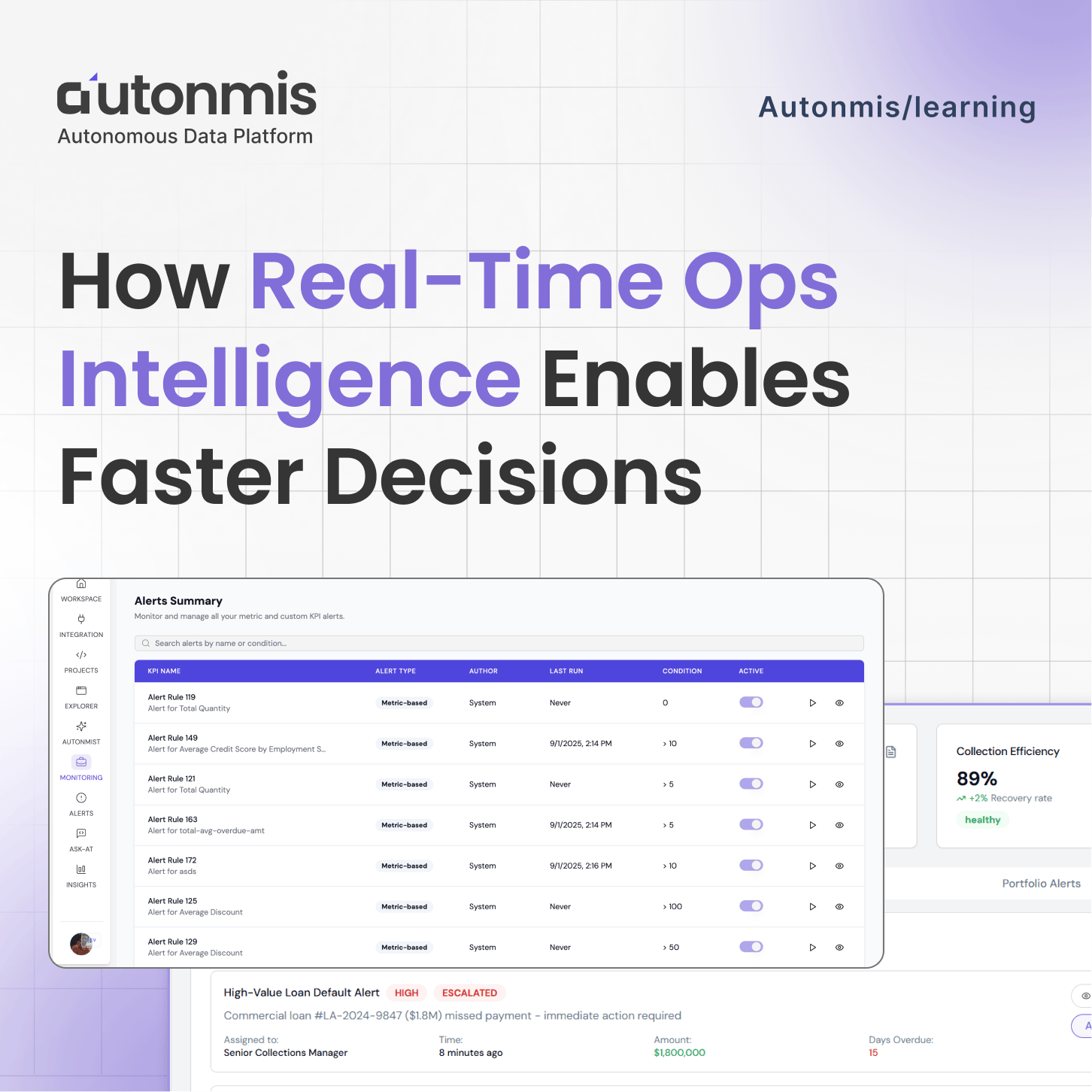

How Real-Time Ops Intelligence Enables Faster Decisions

12/24/2025

AB

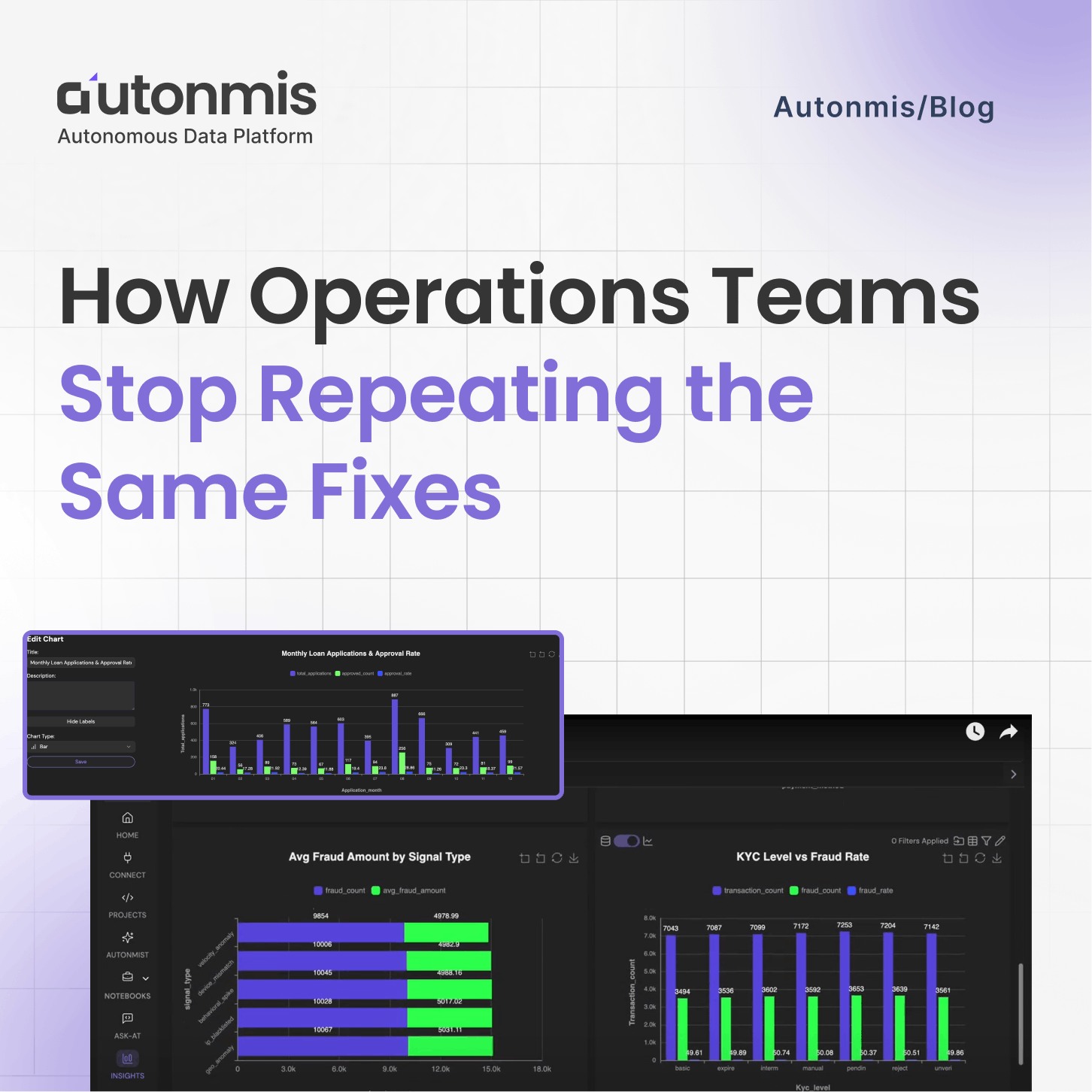

How Operations Teams Stop Repeating the Same Fixes

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.