9/22/2025

AB

The Hidden Cost of Manual Operations in BFSI

Uncover the real cost of manual business operations in BFSI. Explore how outdated processes and fragmented systems can cost you more than you think.

Walk into any bank, NBFC, or fintech lender today, and you’ll see an operations team that looks busy, stretched, and constantly on call. On the surface, things seem fine: loans are disbursed, collections are tracked, compliance reports are filed.

But look closer, and another story emerges. Teams chase SLA breaches across emails, reconcile payments by hand, and prepare MIS packs that are already outdated by the time they reach CXOs.

This is the real cost of manual operations in BFSI - and the hidden cost it carries is far bigger than most leaders realize.

Why manual business operations still dominate BFSI

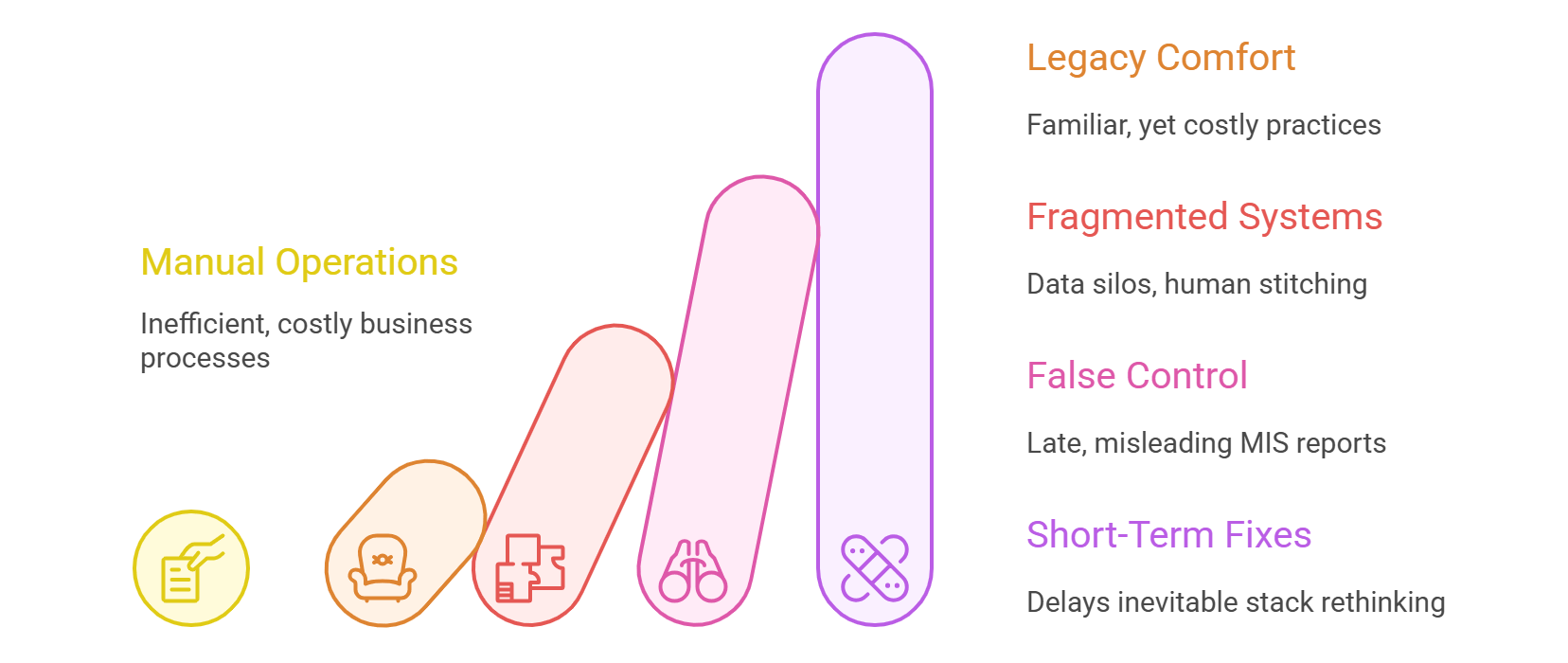

If we all know manual business ops BFSI are inefficient, why do they still persist? A few reasons stand out:

- Legacy comfort – Many ops teams are used to spreadsheets, emails, and firefighting. It feels familiar, even if it’s costly.

- Fragmented systems – LOS, LMS, CRM, payment gateways, bureaus, and collections tools don’t always talk to each other. Stitching data across them is left to humans.

- False sense of control – Leaders often feel they have visibility because “the MIS came in.” But those numbers are stitched together days late, hiding real issues.

- Short-term fixes – Throwing more people at the problem is faster than rethinking the stack. But it only delays the inevitable.

This is how BFSI firms end up running billion-rupee portfolios on what is effectively duct tape: manual reconciliation, copy-paste reports, and late alerts.

Checkout: The Cost of Escalation Delays in Lending Ops

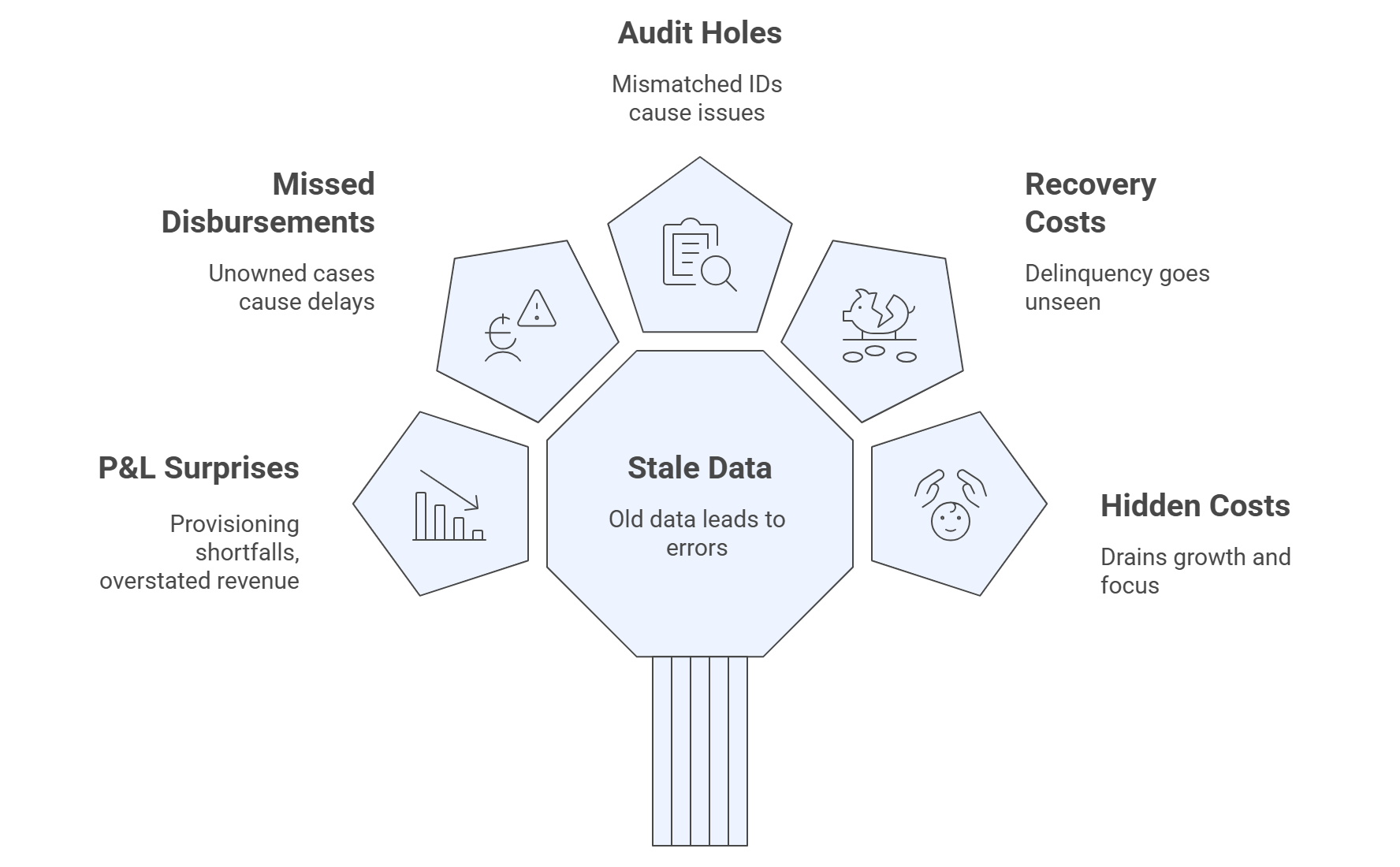

The visible vs hidden costs of manual business ops

Everyone can see the visible costs - time wasted, slow processes, error-prone workflows. But the hidden costs are where the real damage lies.

1. Revenue leakage & penalties

- SLA breaches mean paying penalties to partners.

- Duplicate disbursements or missed reconciliations create direct financial losses.

- Collections signals missed for weeks lead to creep in NPAs.

Example: A mid-sized NBFC discovered ₹10 crore worth of loans had been wrongly marked overdue because reconciliation was delayed. The loans were repaid, but revenue was lost in the accounting fog.

2. Time drain & productivity loss

Ops teams spend:

- Hours every day reconciling payments and updating loan status manually.

- Days every month preparing MIS packs across BI tools, Excel, and extracts.

- Weeks every quarter firefighting errors during audits.

This time drain is invisible in P&L, but it’s real. Leaders think teams are “fully utilized,” but in reality, they’re stuck in low-value tasks that don’t move the business forward.

3. Poor decision-making

Delayed MIS is more dangerous than no MIS at all. Why? Because it creates a false sense of security.

- Dashboards show “green” while disbursements are actually stuck.

- CXOs make credit and provisioning calls based on 5–10 day-old data.

- Audits get defensive instead of strategic because numbers can’t be trusted.

In BFSI, where risks compound daily, late or distorted decisions cost millions.

4. Long-tail costs leaders rarely see

The hidden cost of manual ops extends far beyond money and time.

- Customer trust erosion – An EMI deducted twice with no quick resolution can turn a loyal borrower into a vocal critic.

- Employee burnout – Ops talent stuck in rework loops eventually quits, taking hard-won process knowledge with them.

- Scalability ceiling – Every new loan product or growth push requires adding headcount, not efficiency.

- Regulatory friction – Late, inaccurate, or inconsistent MIS creates credibility gaps with regulators.

This is why manual business ops aren’t just inefficient, they are a systemic risk multiplier for BFSI institutions.

Checkout: Top 6 Ways to Improve Business Operations (That Actually Work)

Why the hidden cost is growing

The cost of manual operations isn’t static - it’s rising. Here’s why:

- Faster growth cycles – Fintechs and NBFCs today are onboarding thousands of loans a day. Manual ops can’t keep up without breaking.

- Tighter compliance – Regulators expect accurate, real-time reporting. Delays or errors now trigger not just penalties, but trust issues.

- Customer expectations – Borrowers expect Amazon-level speed and accuracy. A delay of even a few hours feels unacceptable.

- Complex ecosystems – With multiple loan products, co-lending partners, and payment channels, reconciliation complexity has grown exponentially.

What used to be “manageable inefficiency” five years ago is now an existential problem for BFSI leaders.

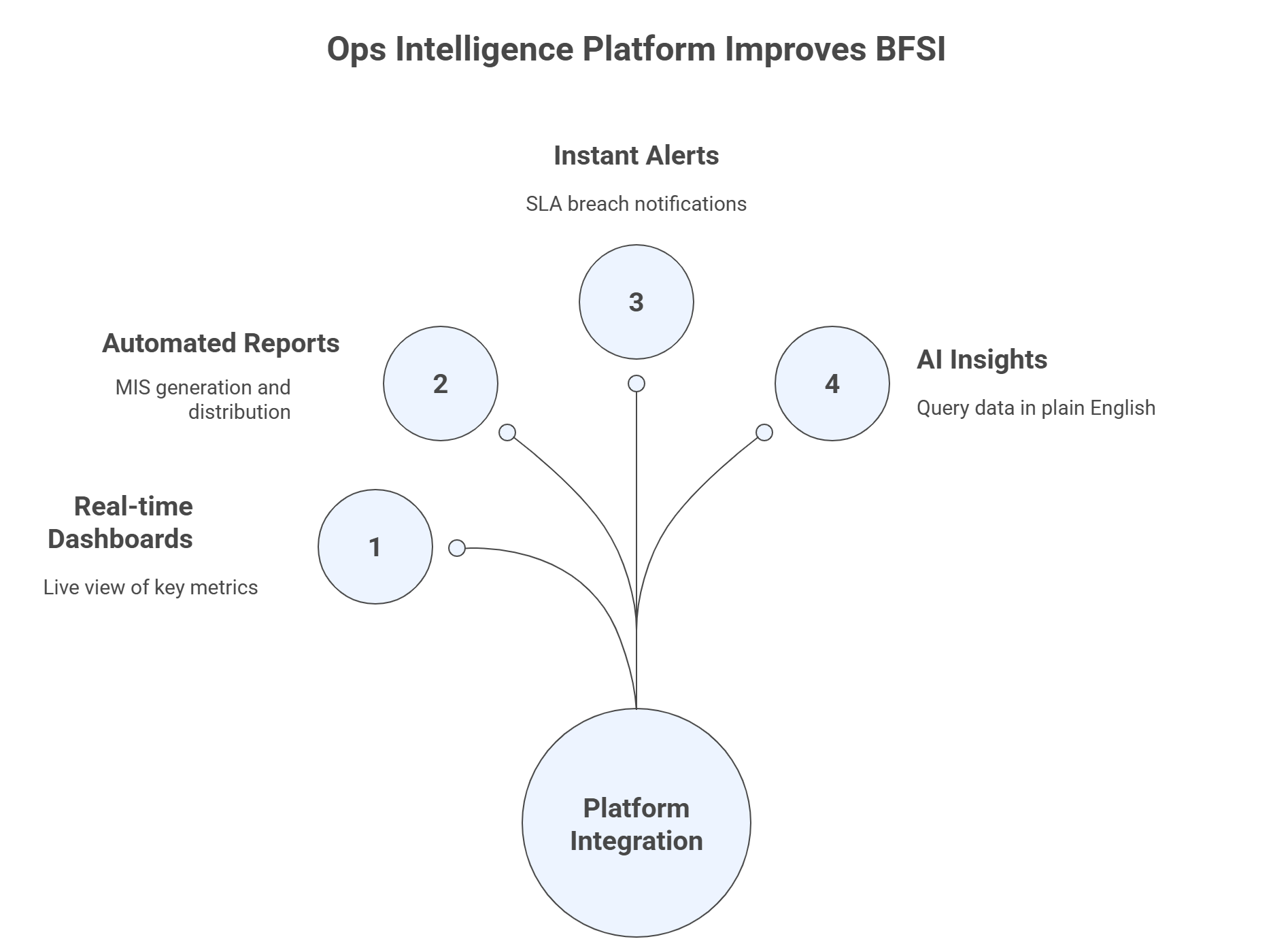

The alternative: From firefighting to command center

This is where modern ops intelligence platforms come in. Instead of scattered data and delayed reporting, BFSI firms get a live, unified command center.

Platforms like Autonmis were built by operators who faced these challenges first-hand while scaling lending ops at Paytm. The goal: visibility, control, and accountability in real time.

Here’s how it works:

Integration

- Connects with LOS, LMS, CRM, bureau, payments, and collections systems.

- Secure, modular, and runs on your cloud (or ours).

- Zero disruption to existing workflows.

Dashboards

- Real-time view of disbursements, repayments, NPAs, SLA adherence.

- No more waiting for MIS packs.

Reports

- Automated MIS generation & distribution.

- Delivered directly to leadership or regulators via email/Slack.

- Cuts MIS prep from days to minutes

Alerts

- Instant SLA breach alerts with ownership assignment.

- No more silent failures.

AI Insights

- Query ops data in plain English.

- Auto-surface anomalies, prioritize risks, suggest next actions.

The result:

- Go-live in 3-4 weeks, not months.

- 40% lower ops cost vs typical setups.

- Teams move from reactive firefighting → proactive control.

Checkout: What is Operational Intelligence (OI)? Complete 2025 Overview

What leaders should be asking

If you’re leading a BFSI organization, here are four questions worth asking today:

- How much revenue leakage is hiding in our reconciliations and SLA penalties?

- Are our CXO decisions based on live truth - or stitched, outdated MIS?

- What is the opportunity cost of keeping ops talent stuck in manual loops?

- Can we scale our operations 2–3x without doubling headcount?

If these questions make you pause, chances are the manual ops tax is already eating into your growth.

The road ahead

The truth is, BFSI firms don’t have the luxury of ignoring manual ops anymore. With regulators, customers, and competitors all raising the bar, the hidden cost of inefficiency is now a competitive disadvantage.

Leaders who act early can turn operations into a strategic advantage:

- Faster launches of new products.

- Better compliance posture.

- Happier customers and employees.

- Stronger unit economics.

Those who delay will keep paying the tax - in revenue leakage, penalties, missed opportunities, and eventually, reputation.

Closing thoughts

Manual operations in BFSI aren’t just a nuisance. They’re a silent tax that compounds every day - draining money, time, and trust.

The good news? The technology to fix it exists, and it doesn’t require a multi-year transformation. With platforms like Autonmis, lenders can unify ops, cut hidden costs, and move from firefighting to growth - all in weeks, not months.

Recommended Learning Articles

2/6/2026

AB

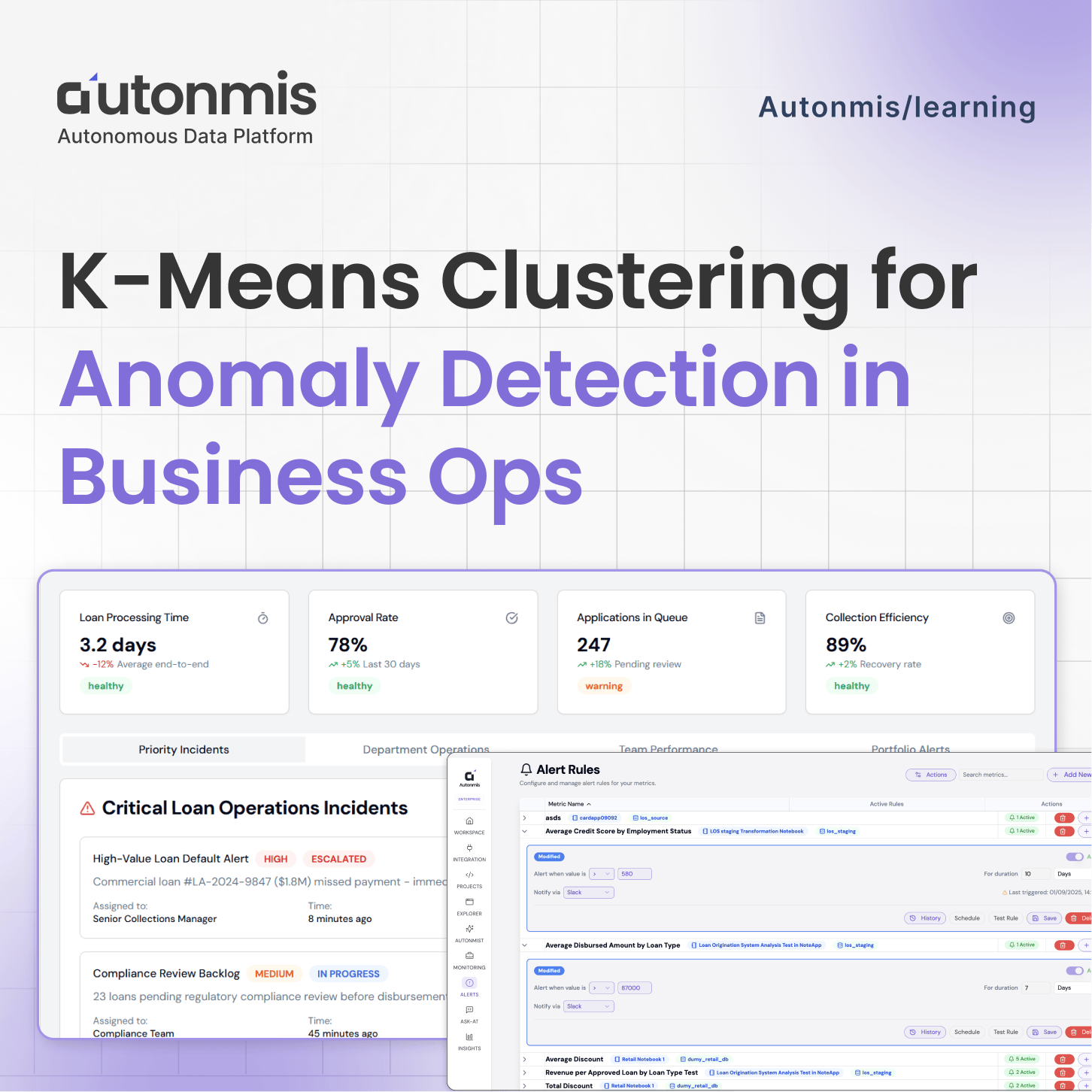

K-Means Clustering for Anomaly Detection in Business Operations

1/15/2026

AB

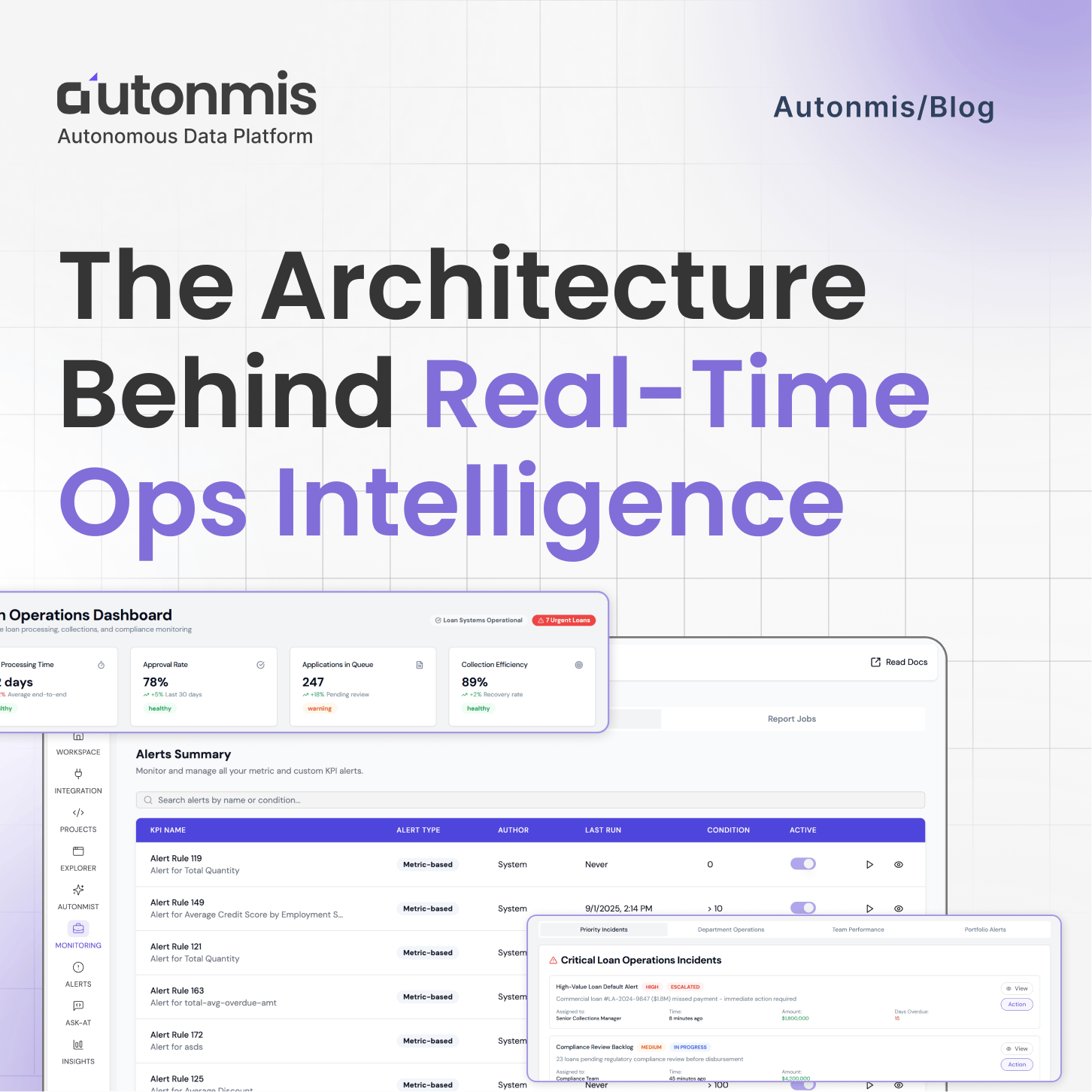

The Architecture Behind Real-Time Ops Intelligence: RAG + NL2SQL Explained

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.