Table of Contents

Loading table of contents...

How Ops Intelligence Reduces NPAs: Metrics That Matter

December 1, 2025

AB

Non-Performing Assets (NPAs) are more than just a line item on a balance sheet. For lenders, they are a constant reminder that operational inefficiencies, incomplete visibility, or delayed actions can have real financial and reputational consequences.

If you’re a CTO, Head of Operations, or a risk leader, the question is not just “How can we reduce NPAs?” but “How can we proactively detect and prevent them?” That’s where Ops Intelligence comes in. It transforms operational data from reactive reports into actionable insights, enabling teams to manage risk with precision and scale.

What is Ops Intelligence? And Why Does It Matter for NPAs?

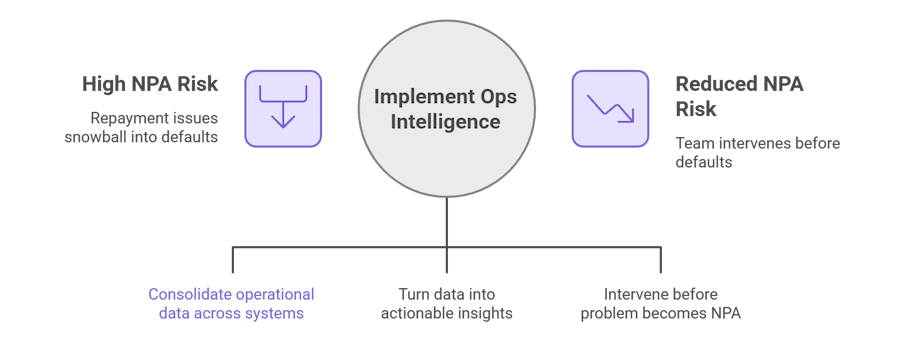

Ops Intelligence is the practice of consolidating operational data across systems, collections, loan origination, third-party APIs, reconciliations, customer interactions, and turning it into insights that guide decisions.

Think of it as a command center for operational risk: it doesn’t just tell you something went wrong; it tells you why it went wrong, where it’s impacting your business, and what to do next.

For NPAs, this matters because:

- A delay in detecting repayment issues can snowball into defaults.

- Manual dashboards often miss early warning signals buried in transactional data.

- Cross-functional dependencies, payments, disbursements, reconciliations, customer communications are rarely visible in a single view.

Ops Intelligence reduces NPAs, it connects the dots, so your team can intervene before a problem becomes a non-performing asset.

Checkout: Top 6 Ways AI Is Transforming Business Operations

The Real Costs of NPAs

Before diving into metrics, it’s important to understand why NPAs are such a critical concern:

- Financial impact: Interest income stops accruing, and provisions need to be made for bad loans.

- Operational overhead: Collections, legal follow-ups, and audit tasks increase significantly.

- Reputational risk: Persistent NPAs signal systemic issues to investors, regulators, and customers.

- Strategic opportunity cost: Capital tied up in non-performing loans could have been deployed to growth initiatives.

In short, NPAs are not just about finance; they reflect operational health and governance.

Key Metrics That Matter for Reducing NPA

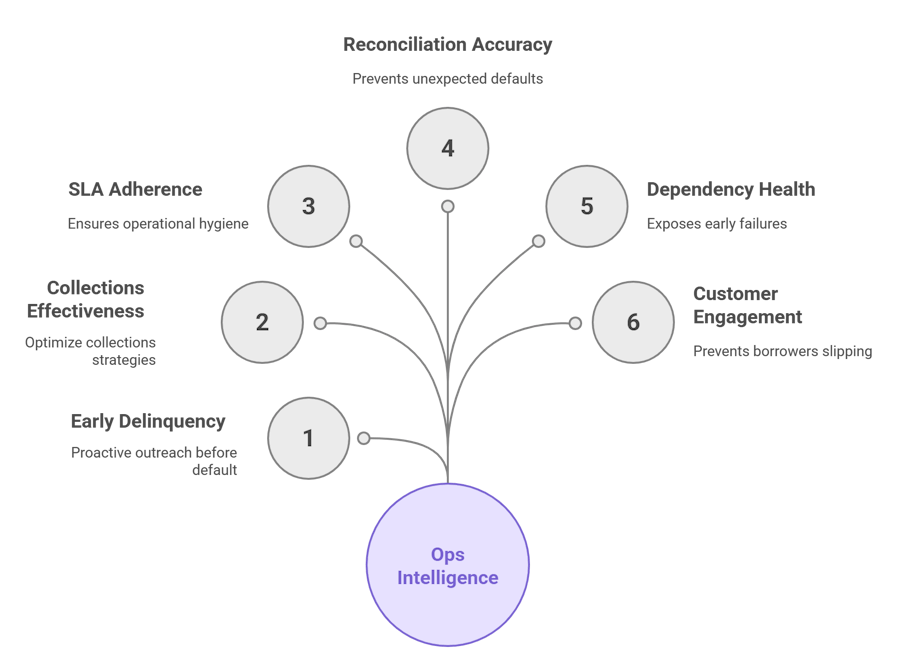

To reduce NPAs effectively, you need more than reports. You need metrics that tie operational performance to business outcomes. Ops Intelligence reduces NPAs, it helps track these critical measures:

1. Early-Stage Delinquency Metrics

- Percentage of loans delayed by 1–30 days (D1–D30).

- Segment by loan type, customer profile, and branch/region.

Why it matters: Early delinquencies are leading indicators of NPAs. Tracking them allows proactive outreach before loans default.

2. Collections Effectiveness

- Promise-to-pay fulfillment rate: Tracks whether borrowers who committed to pay actually did.

- Recovery success rate: Measures successful collection per recovery attempt.

Why it matters: Not all delays lead to NPAs equally. Intelligence business operations surfaces which interactions and strategies actually work, allowing teams to optimize collections.

3. Operational SLA Adherence

- Track SLA compliance for loan processing, repayment follow-ups, and escalation resolution.

- Monitor threshold breaches and response times.

Why it matters: Delayed operations e.g., late EMI reminders or unresolved disputes can cascade into NPAs. SLA monitoring ensures operational hygiene.

4. Reconciliation Accuracy

- Track mismatch rates in repayment processing and settlement.

- Monitor third-party vendor reconciliation issues.

Why it matters: Small errors in reconciliations can go unnoticed until they impact multiple loans, creating unexpected defaults.

5. Dependency Health Metrics

- API latency and uptime for payment gateways, credit bureaus, and risk scoring systems.

- Status of partner integrations critical for loan origination and monitoring.

Why it matters: NPAs often emerge from invisible dependency failures. Ops Intelligence exposes these early.

6. Customer Engagement Metrics

- Response times to borrower queries and complaints.

- Frequency of failed communications (SMS/email/IVR).

- Borrower risk profile updates in real time.

Why it matters: Timely engagement can prevent defaults. Ops Intelligence ensures no borrower slips through the cracks.

Checkout: The Hidden Cost of Manual Operations in BFSI

How Ops Intelligence Transforms NPA Management

Simply having metrics is not enough. The power comes from actionable insights:

- Prioritized Alerts

Ops Intelligence can alert your team based on business impact, not just severity. Example: a delayed payment from a high-value SME triggers an immediate priority alert, whereas a small retail loan delay may be monitored normally. - Root Cause Visibility

Rather than chasing symptoms, Ops Intelligence links operational signals to root causes, API failures, missing reconciliations, or delayed approvals. - Predictive Insights

Historical patterns can be analyzed to identify borrowers or portfolios at high risk, enabling proactive interventions. - Cross-Functional Alignment

Collections, risk, compliance, and operations teams gain a unified view. Everyone acts on the same facts, reducing handoff delays. - Automated Workflows

Alerts and playbooks can trigger automated communications, assignment routing, or repayment reminders, ensuring no loan falls through process gaps.

A Practical Example: SME Loan Portfolio

Consider an SME lending operation:

- Problem: 2–5% of loans go into NPA each quarter. Collections team reacts only after 90 days past due.

- Ops Intelligence Intervention:

- D1–D30 delinquency tracked in real time

- Automated priority alerts for high-value loans

- SLA adherence monitored for collections follow-ups

- Third-party API health tracked to ensure payment data is timely

Result:

Early intervention reduces defaults by 60%, recovery efforts are more targeted, and operational friction drops significantly.

Best Practices for Leaders

To maximize the impact of Ops Intelligence in NPA reduction:

- Define clear business KPIs linked to NPAs: early delinquency, SLA adherence, collection effectiveness.

- Focus on high-value signals first: not every alert matters equally.

- Integrate data across systems: loan origination, payments, customer engagement, risk scoring.

- Automate routine responses: reminders, escalations, reconciliation fixes.

- Review metrics regularly: dashboards alone don’t improve operations, leadership action does.

- Adopt a culture of accountability: Ops Intelligence works best when metrics are tied to ownership and decision-making.

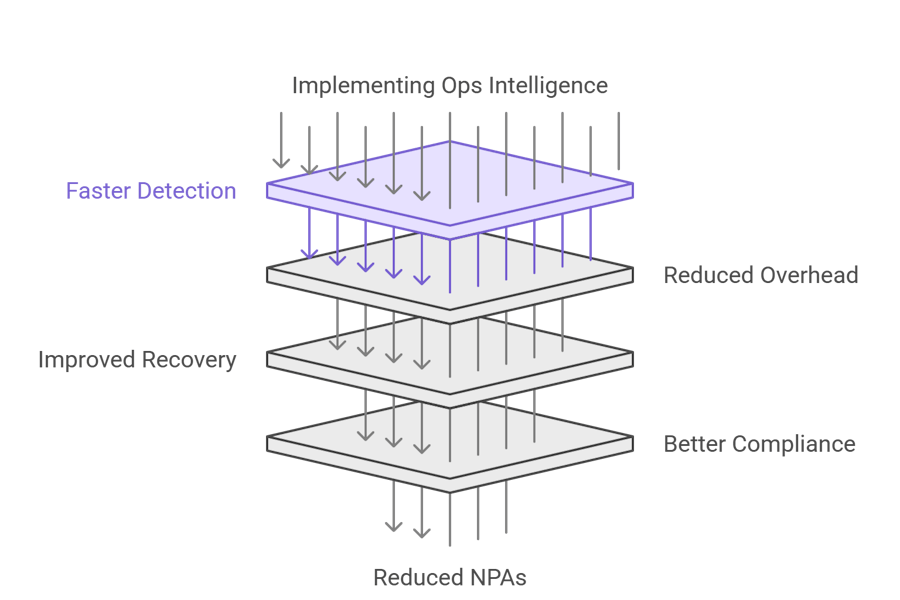

The ROI of Ops Intelligence in NPA Reduction

By implementing Ops Intelligence, organizations often see:

- Faster detection of at-risk loans

- Reduced operational overhead in collections

- Improved recovery rates on delinquent accounts

- Better compliance reporting and audit readiness

- Overall reduction in NPAs and associated financial risk

In short, Ops Intelligence transforms NPA management from reactive firefighting into proactive portfolio health management.

Checkout: What is Operational Intelligence (OI)? Complete 2025 Overview

Final Thoughts

NPAs will always be part of lending operations. But how they impact your business depends on visibility, speed, and intelligence.

Ops Intelligence bridges the gap between operational data and business outcomes. It gives leaders a single lens to monitor, predict, and act, ensuring that NPAs don’t become a systemic problem, but a manageable risk.

For high-level decision-makers, the takeaway is simple: measure what matters, act early, and tie operations to business impact. That’s how you reduce NPAs, protect revenue, and make your operations a true strategic asset.

Recommended Blogs

2/10/2026

AB

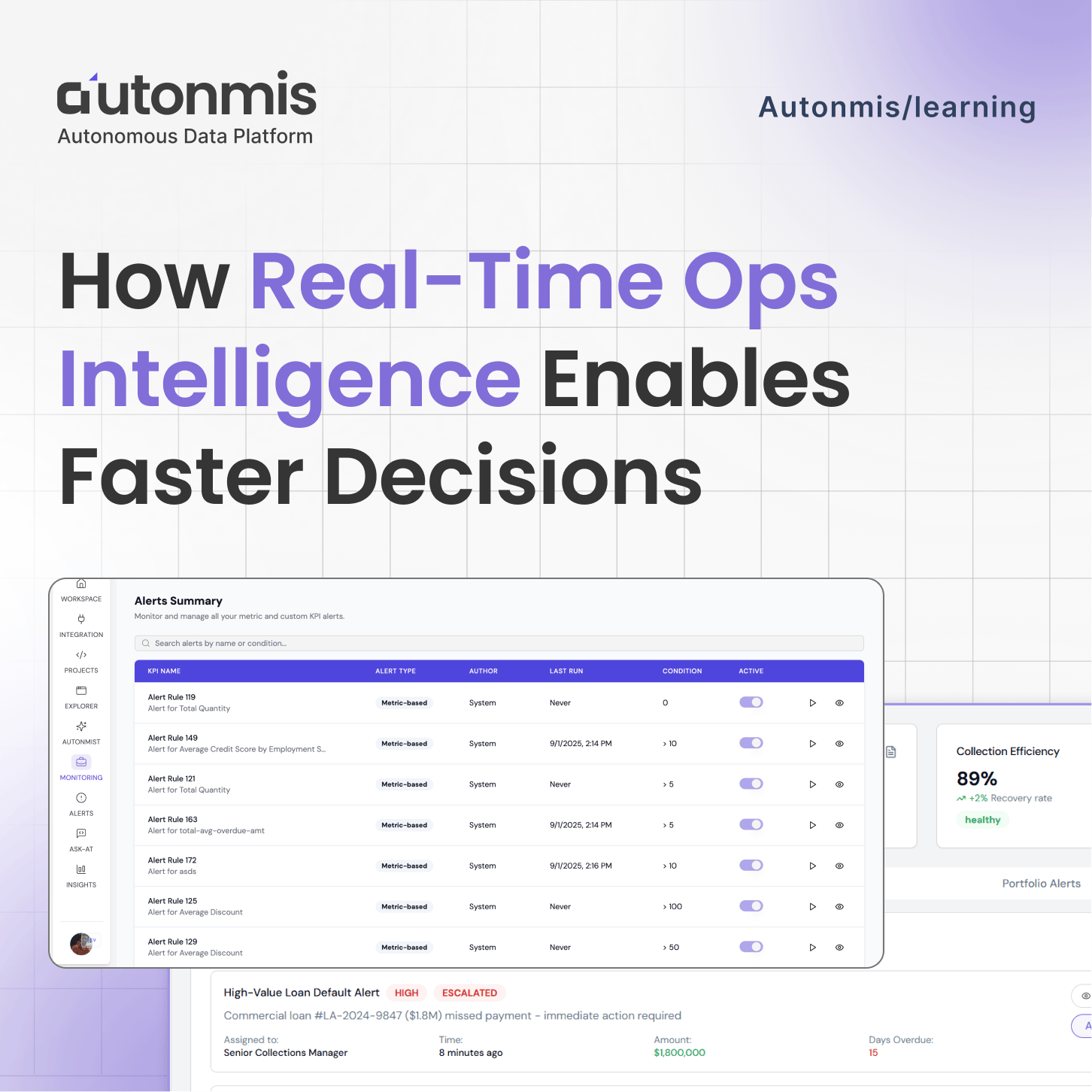

How Real-Time Ops Intelligence Enables Faster Decisions

12/24/2025

AB

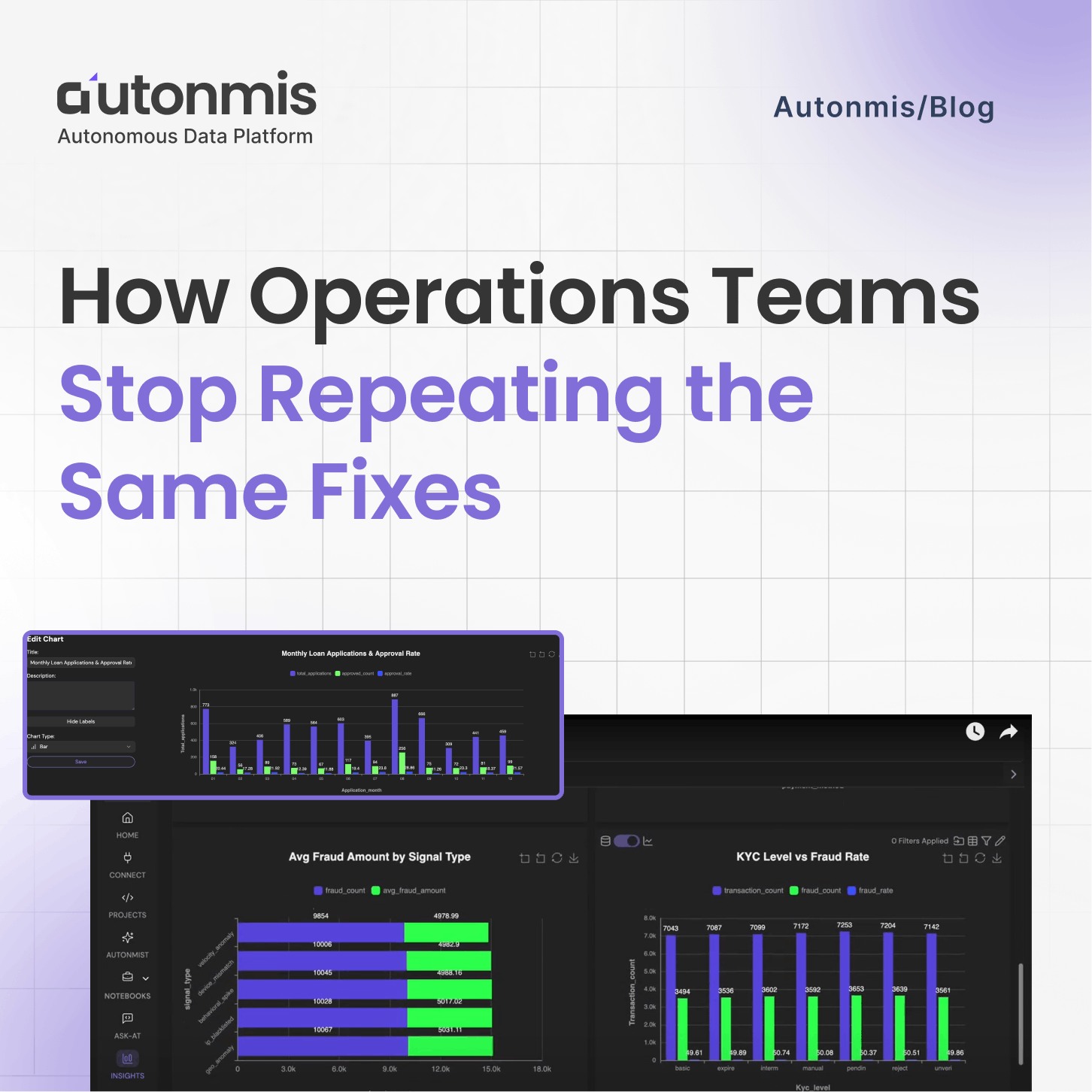

How Operations Teams Stop Repeating the Same Fixes

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.