12/26/2024

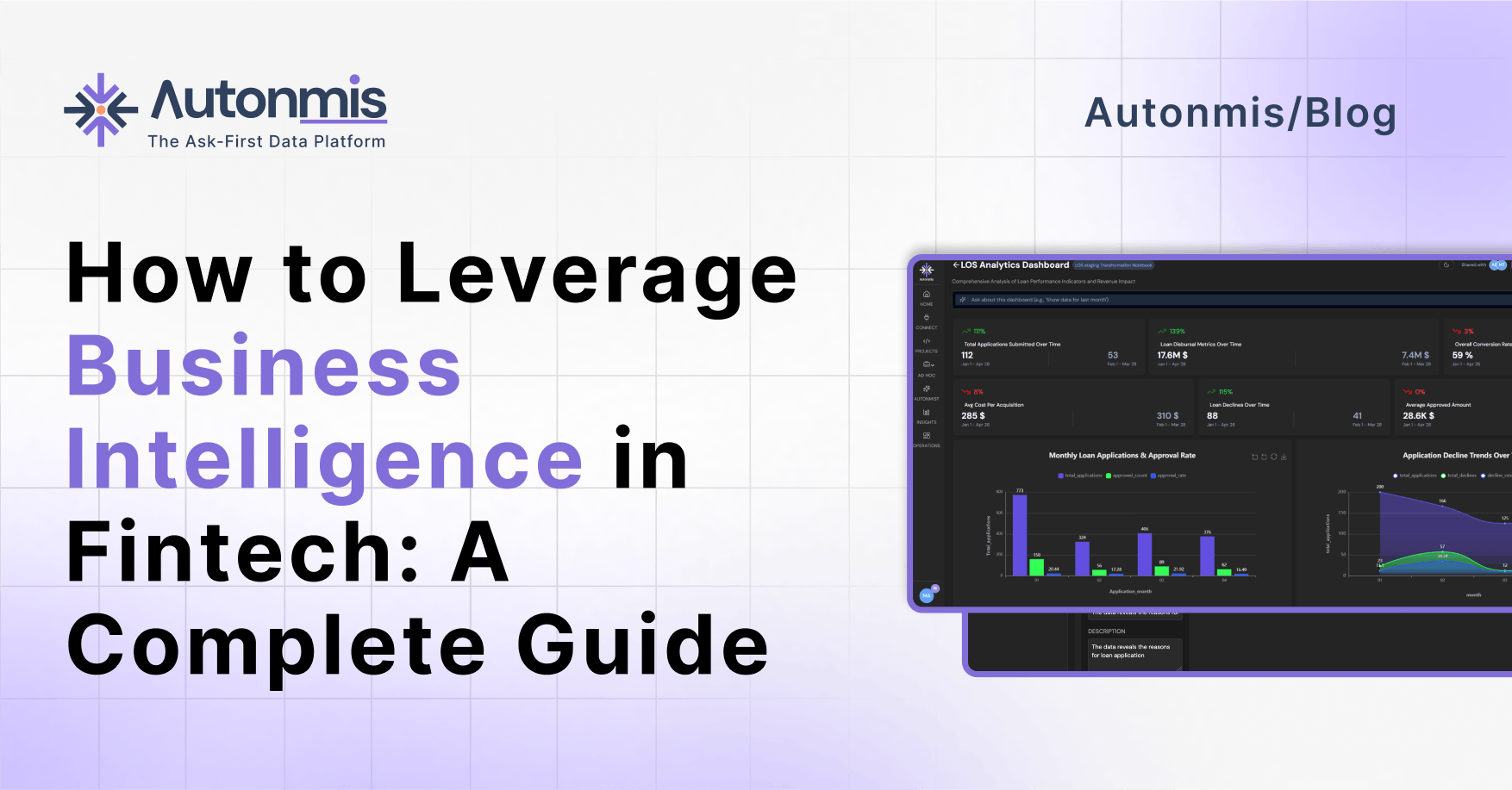

How to Leverage Business Intelligence in Fintech

Transform your fintech and microfinance operations with data-driven insights. Learn how Business Intelligence is revolutionizing financial services through advanced analytics and real-time monitoring.

Modern fintech and microfinance institutions are leveraging Business Intelligence (BI) to transform their operations, enhance risk management, and improve customer service. This comprehensive guide explores how BI solutions drive innovation and efficiency in financial services.

The Impact of Business Intelligence in Financial Services

Key Benefits

- Enhanced Risk Assessment Credit scoring automation Fraud detection Default prediction Portfolio risk analysis

- Operational Efficiency Process automation Cost reduction Resource optimization Performance tracking

- Customer Intelligence Behavior analysis Segmentation Lifetime value prediction Churn prevention

Essential Financial KPIs and Metrics

1. Portfolio Performance

- Loan disbursement rates

- Collection efficiency

- Portfolio at risk (PAR)

- Non-performing loan ratio

2. Customer Metrics

- Customer acquisition cost

- Customer lifetime value

- Active user ratio

- Churn rate

3. Operational Metrics

- Processing time

- Approval rates

- Operating expense ratio

- Cost per loan

Implementing Business Intelligence in Fintech

Data Collection and Integration

- Key Data Sources Transaction records Customer applications Credit bureau data Payment history Social media data

- Integration Requirements Real-time processing Secure data handling Compliance monitoring API connectivity

Analysis and Reporting

Key Use Cases in Fintech

1. Credit Risk Assessment

- Automated scoring models

- Behavioral analysis

- Default prediction

- Collection optimization

2. Fraud Detection

- Real-time monitoring

- Pattern recognition

- Anomaly detection

- Risk flagging

3. Customer Analytics

- Segmentation

- Product recommendations

- Cross-selling opportunities

- Retention strategies

Advanced Data Analytics Implementation for Fintech

Predictive Models

Real-time Monitoring

- Transaction monitoring

- Fraud detection

- Risk alerts

- Compliance checks

Streamlining Financial Analytics with Modern Tools

Autonmis provides fintech organizations with:

Integrated Analytics Environment

- SQL and Python integration for financial analysis

- Direct connection to financial data sources

- AI-assisted query development

- Secure team collaboration

Implementation Benefits

- Connect multiple data sources securely

- Create custom analytics workflows

- Build real-time monitoring dashboards

- Share insights across teams

Best Practices for Fintech Business Intelligence

1. Data Security and Compliance

- Implement encryption

- Ensure regulatory compliance

- Maintain audit trails

- Control access levels

2. Risk Management

- Real-time monitoring

- Automated alerts

- Risk scoring

- Portfolio analysis

3. Performance Optimization

- Process automation

- Resource allocation

- Cost monitoring

- Efficiency tracking

ROI and Performance Metrics

Measuring Success

- Financial Metrics Risk reduction Cost savings Revenue growth Operational efficiency

- Operational Benefits Faster processing Better decisions Improved accuracy Enhanced compliance

Future Trends in Fintech BI

Emerging Technologies

- AI-Powered Analytics Advanced risk models Automated decisioning Predictive analytics Natural language processing

- Real-time Processing Instant analytics Live monitoring Dynamic reporting Automated alerts

Conclusion

Business Intelligence is transforming fintech and microfinance by enabling data-driven decision-making and enhanced risk management. Success in this space requires robust tools that can handle complex financial data while maintaining security and compliance.

For financial institutions looking to enhance their analytical capabilities, platforms like Autonmis provide an integrated environment where you can securely connect, analyze, and visualize your financial data. Whether you're focusing on risk management, customer analytics, or operational efficiency, having the right tools and approach is crucial for success.

Ready to transform your financial analytics? Visit Autonmis to learn how our platform can help you implement effective BI solutions for your fintech or microfinance organization.

Recommended Learning Articles

2/6/2026

AB

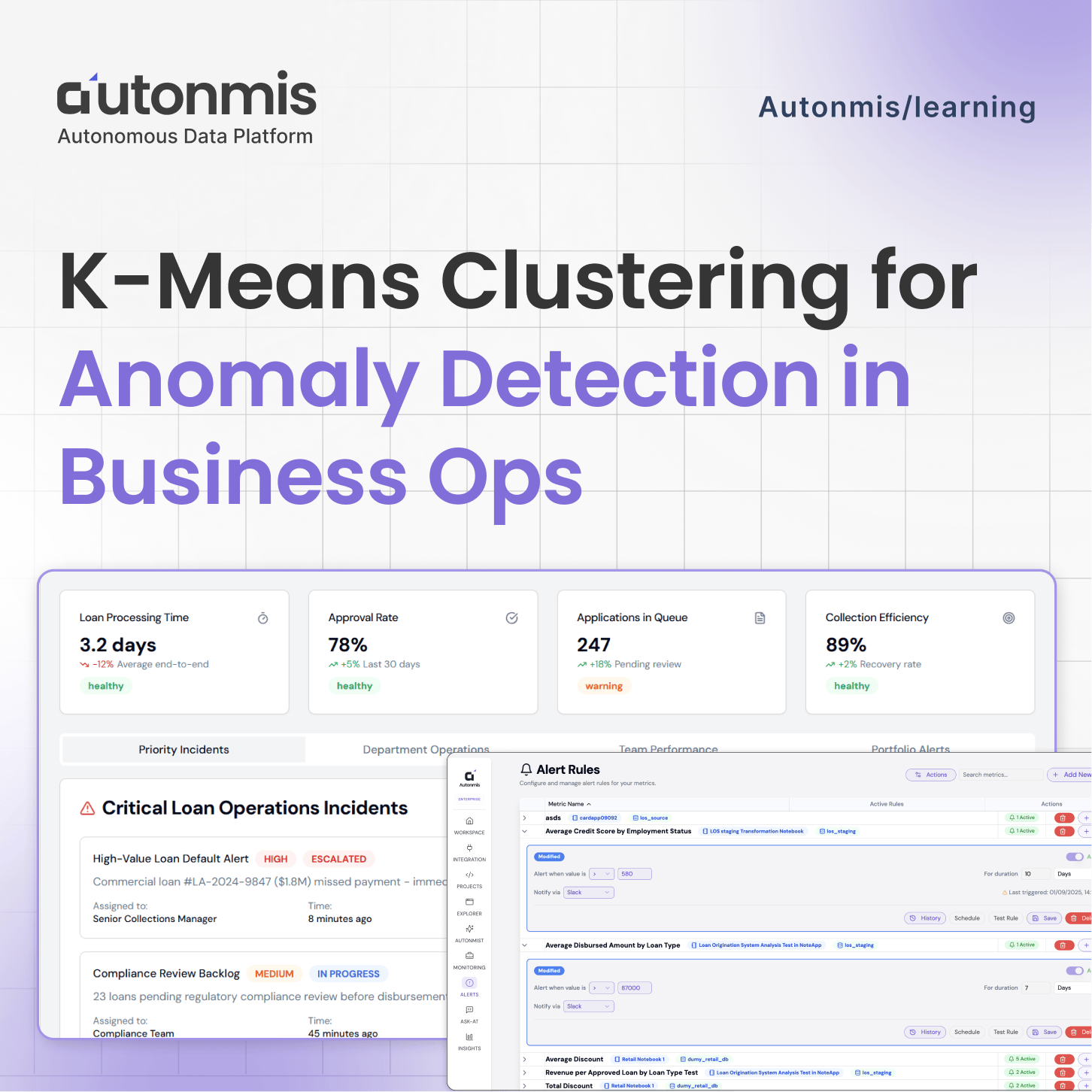

K-Means Clustering for Anomaly Detection in Business Operations

1/15/2026

AB

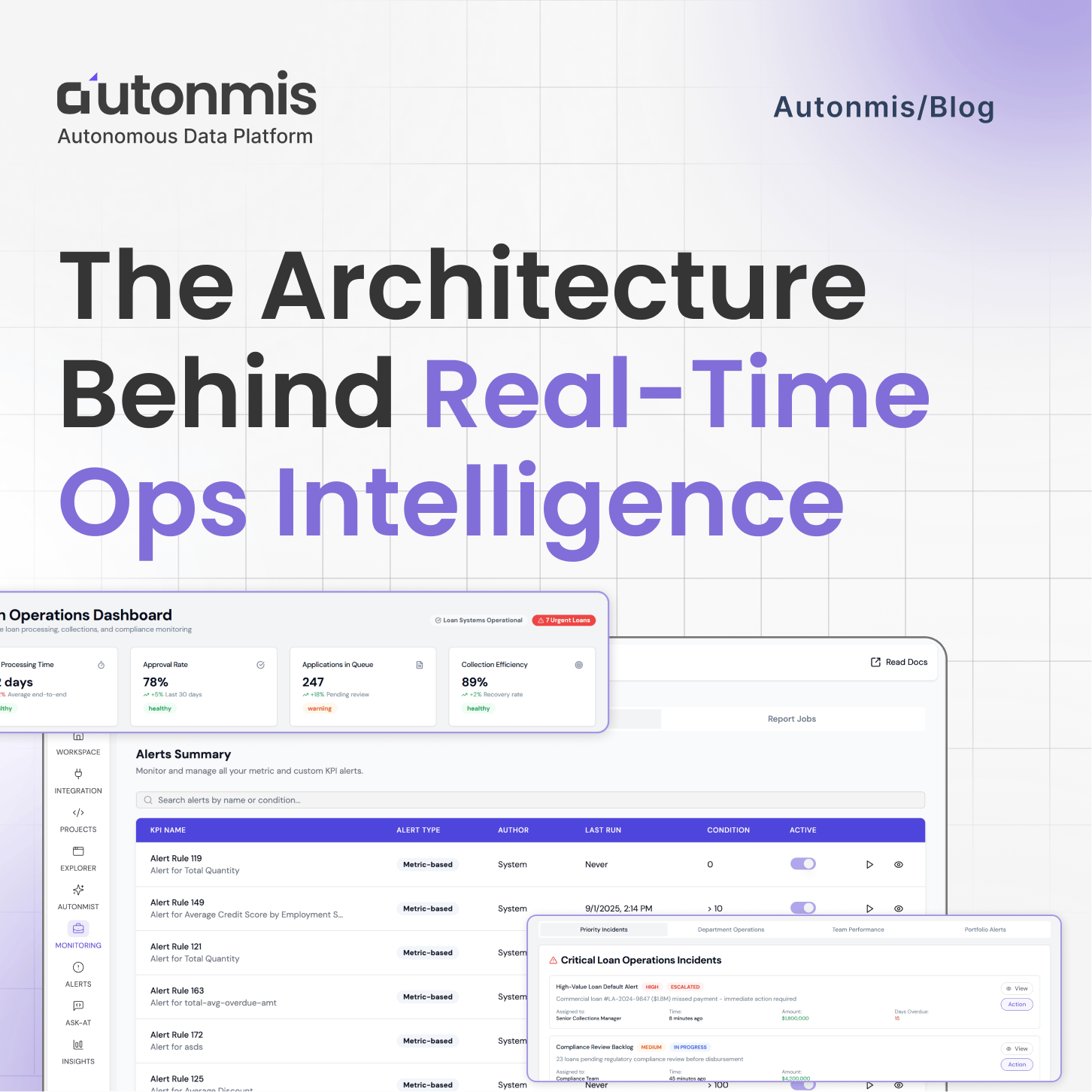

The Architecture Behind Real-Time Ops Intelligence: RAG + NL2SQL Explained

Actionable Operations Excellence

Autonmis helps modern teams own their entire operations and data workflow — fast, simple, and cost-effective.